Why You Should Join Loop

Ramp for logistics.

TL;DR: Loop has grown booked payments volume from 0 to 4 billion over the past two years. They’re currently hiring New Grad Software Engineers, Software Engineers, Product Designers, and more in San Francisco and Chicago.

If you’re interested in roles with any of the companies we’ve covered (or the unreleased ones we have in our pipeline 👀), please fill out this form to join our talent pool.

Welcome to “Why You Should Join,” a monthly newsletter highlighting early-stage startups on track to becoming generational companies. On the first Monday of each month, we cut through the noise by recommending one startup based on thorough research and inside information from partnered venture firms. We go deeper than any other source to help ambitious new grads, FAANG veterans, and experienced operators find the right company to join. Sound interesting? Join the family and subscribe here:

Why You Should Join Loop

(Click the link to read online).

In March of 2021, a 400 meter long container ship called the Ever Given got stuck in the Suez Canal. It got stuck in such a way that the entire canal was blocked, crippling global trade for a week and causing between 6 and 10 billion dollars worth of damages.

You probably remember this - it was all over the news.

It spawned lots of memes.

But did you know that just two years earlier, the exact same ship ran into and severely damaged a tiny, 25 meter pleasure ferry in Germany?

Or that in 2022, the Ever Forward (a different ship by the same company) ran aground in Chesapeake Bay, where it got stuck for over a month?

Or that in 2019, the Ever Summit (yet another cargo ship by the same company) managed to crash into a port crane in Vancouver?

The clear lesson here is to avoid any ship whose name starts with “Ever”.

A secondary lesson might be that freight’s just a really tough business.

As an industry, logistics can be immensely complex — coordinating the intricate flow of goods between ports and destinations or shippers and carriers can be extremely difficult, especially at scale.

Small errors can have large consequences, and large errors can break the global economy.

But, taming that complexity and replacing it with efficiency can mean big opportunities. You might recall us finding this a few months ago when we first explored logistics with Traba (who by the way just raised another round) — as it turns out, there’s lots of room for ambitious startups to improve how ports and warehouses approach temporary staffing.

This month, we’d like to explore another company doing something similar, but in a different part of logistics:

Freight payments.

Payments in freight are just as complex as the distribution networks they serve.

Each invoice a shipper (someone with stuff to ship) receives from a carrier (someone with the truck to ship it) involves lots of different documents (packing lists, weight and inspection tickets, etc.) and lots of different variables (fuel surcharges, gate fees, etc.). This information is generally unstructured, and its format varies widely across the different contracts, invoices, and billing systems used by America’s 1.1 million different carrier companies. This means that for a large shipper like Coca-Coca (who works with 36,000 different carrier partners), handling invoices means reconciling tens of thousands of different payment-related emails, PDFs, CSVs, JPEGs, and EDI 210 transaction sets.

Since there’s no single place where every payment-related document and data source has been cleaned and centralized, it’s nearly impossible for large shippers to get accurate and real-time visibility into their transportation finances. Essentially anything you’d want to do here is difficult:

It’s hard to make sure the invoices you’re receiving are accurate and that you’re not overpaying.

It’s hard to estimate how much you’ll actually spend (given variable/unexpected charges) with a specific route or carrier.

It’s hard to identify bottlenecks and inefficiencies in your transportation network.

Last year, truckers alone carried 11.46 billion tons of primary freight, sending invoices worth 940.8 billion dollars in the process. Because of how convoluted freight billing is, it’s estimated almost 25% those invoices had some kind of error — it was just too overwhelming to check them all.

For an industry that represents 3 percent of US GDP, you’d think we’d have a way to make sure all our spend here were accurate and optimized.

The financial layer of freight needs a source of truth.

Enter: Loop.

Background

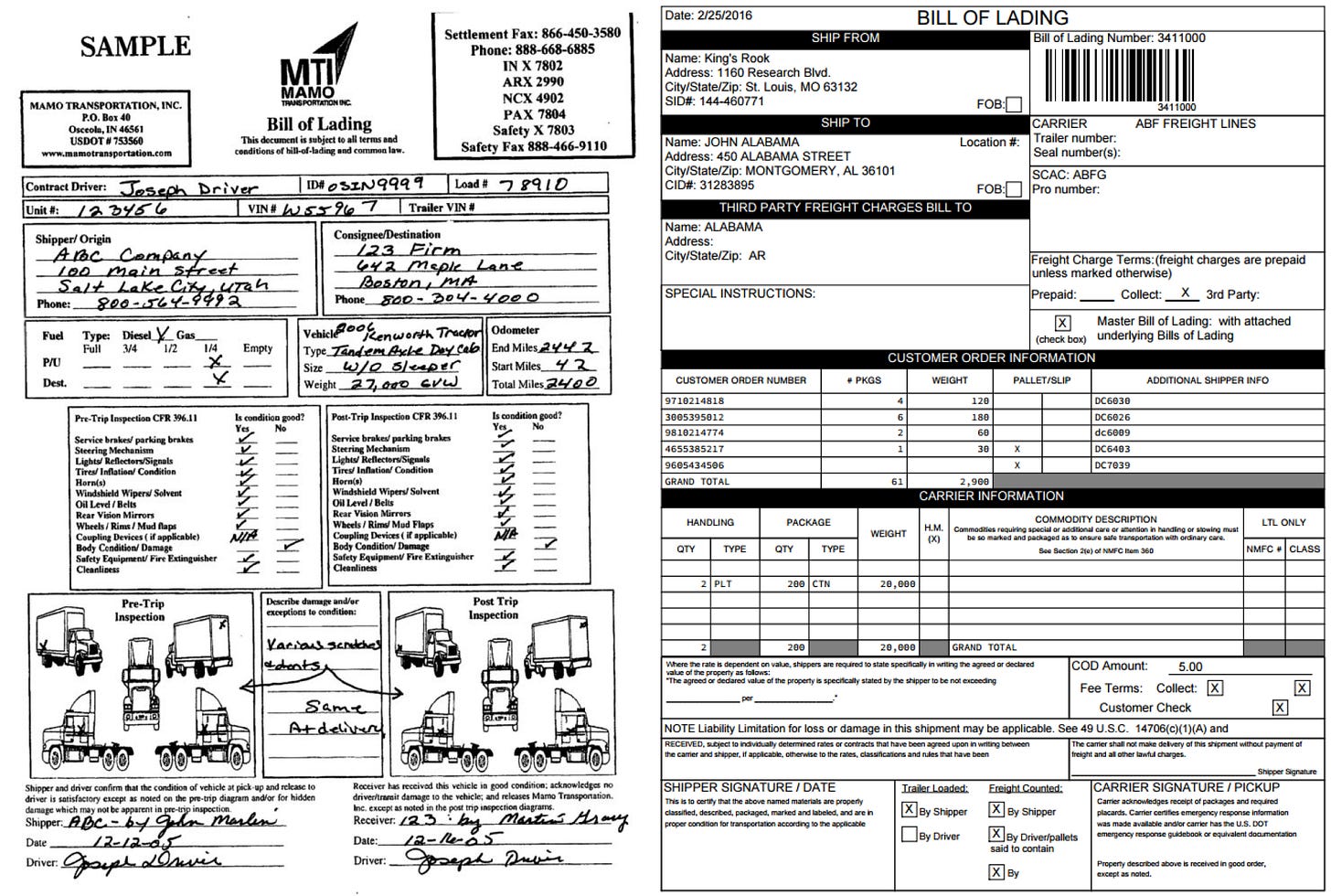

To recap, when a shipper (i.e. Coca-Cola) needs to send some product from a bottling center to a distribution center, they’ll contract a carrier (i.e. a trucking company) to help them do so. During the delivery process, that carrier will generate a good amount of data used to compute the final price. This might include:

Basic figures like freight rates, shipping weights, fuel surcharges, and distance traveled.

Contract specifics like discounts, delivery guarantees, insurance, and gate fees.

Accessorial charges like inside pickup fees, lift gate fees, wait time fees, protection from freezing fees, and weight and inspection fees.

Each of these variables can come with their own supporting documents and details, which themselves can be spread across different document types (bill of ladings, packing lists, etc.), formats (PDFs, photos, EDI 210 transaction sets, etc.), and sources (mail, email, TMSs, ERPs, etc.).

The complexity and fragmentation associated with even one of these invoices can make it difficult for shippers to do something like a simple audit, where you check each charge for accuracy. For instance, investigating an invoice that’s higher than expected, discovering it was caused by an unexpected liftgate fee, determining whether a liftgate was needed, and potentially contesting the charge might mean combing through several different files across several different sources.

As you can imagine, doing this for many different invoices across many different carriers can overwhelm even the largest of transportation and finance teams.

Carriers often charge for fuel, but the amount they charge can be contingent on a specific fuel price index. The example above is taken from a 72 page public Fedex contract, which shows the relationship between the LTL/TL Fuel Surcharge and the current state of the US Energy Information Administration’s Gasoline and Fuel index. Doing an audit of the fuel surcharge (a subpart of a subpart of the final price) means making sure it matches the current fuel price in the index you agreed to tie your pricing relationship to. Naturally, different carriers might use entirely different indices, rates, and file formats. You see why this might be hard to automate?

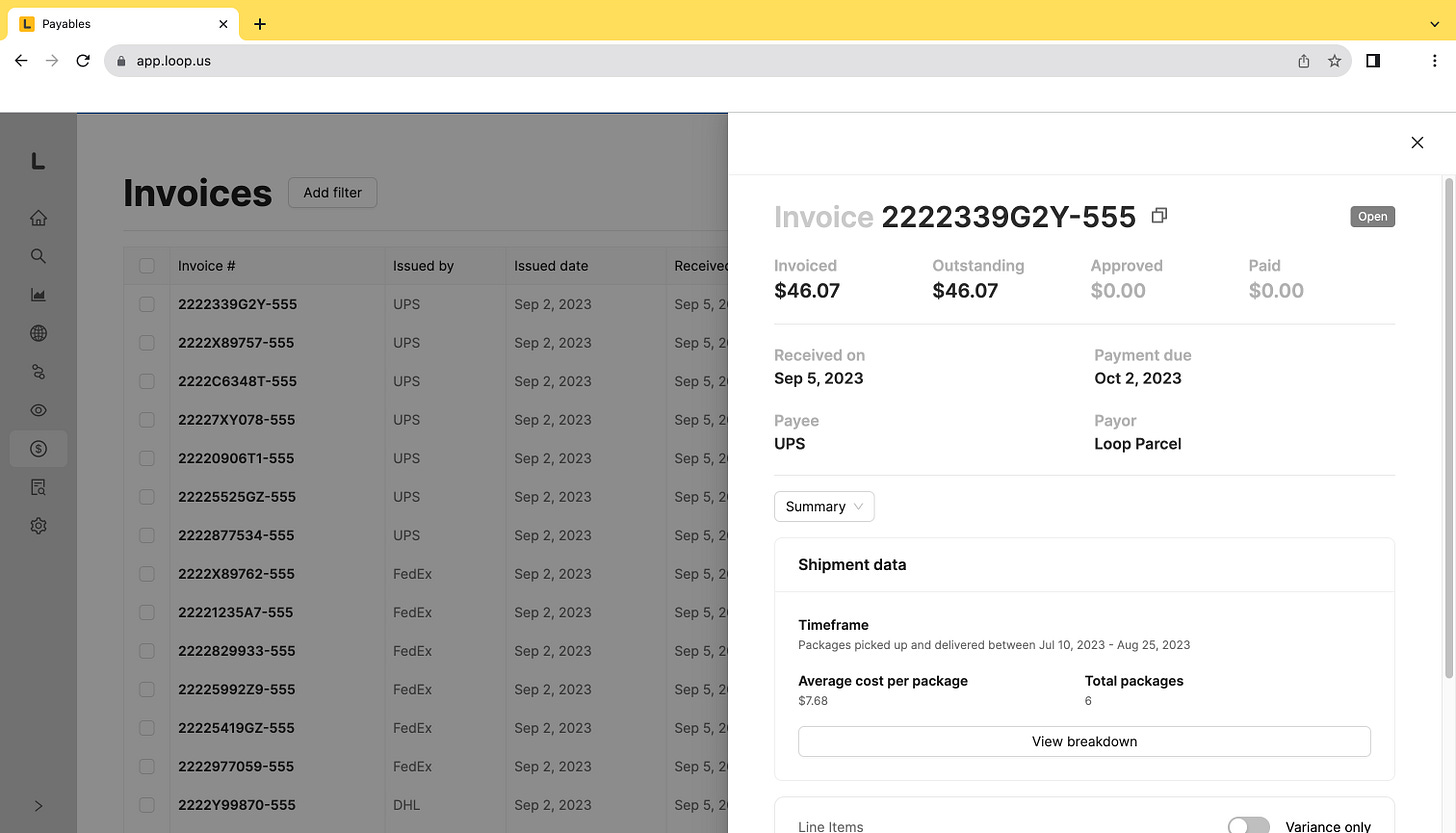

To solve this problem, Loop has built the first platform enabling shippers and third-party logistics providers (3PLs) to centralize all their payments-related data. By leveraging AI to automatically ingest, standardize, and link shipment data across different carriers, file types, file formats, and file sources, Loop is able to structure all the raw and unstructured data shippers and 3PLs normally receive.

This industry-first system of record would be valuable enough on its own, but Loop builds on top of it with a series of features that help automate every other finance-related workflow. By automating everything from invoice audits to dispute resolution to scenario planning to data visualization to rules-based cost allocation to the actual payments themselves, Loop creates lots of value for their customers:

Short term, Loop helps shippers reduce unnecessary spend. By automatically auditing every invoice for errors and discrepancies, Loop makes identifying and resolving that unexpected liftgate fee from earlier is much easier.

Long term, Loop helps shippers optimize their entire transportation budgets. With the analytics uniquely enabled by their data layer, shippers can forecast spend per carrier or product far more accurately, which can be crucial for forecasting, contingency planning, network scenario planning.

Collectively, using Loop results in a 2-7% net reduction in transportation spend and an 80% increase in back office productivity, both incredible metrics considering the vast budget/team sizes of their customers. Unlike most of their competitors, who take a portion of the savings identified, Loop uses a SaaS-based model that’s offers a flat fee based on payment volume processed.

One way to understand Loop’s game is by comparison to another popular fintech, Ramp. Like Ramp, Loop’s initial wedge was helping customers spend less - Ramp via automated insights and partnerships, and Loop via automated freight audits and analytics. Like Ramp, Loop is leveraging this wedge to centralize all of their customers’ finance and payments related-data, something which uniquely positions them to build downstream products on top. As we’ll see, this is exactly what they’re doing — Loop wants to be the ultimate platform for everything at the intersection of supply chain and finance.

Loop launched publicly in 2021 and booked $25 million worth of invoices their first month in production. In the two years since, they’ve continued to grow swiftly — they now book $4 billion worth of payments annually. Their customers include some of the largest shippers and third-party logistics providers (3PLs) in the world, including J.P. Morgan Chase, Nationwide, Loadsmart, and several others we can’t share.

Customers love them: GILLIG, a large manufacturer of transit buses, shared that they went from manually “gut checking” 30% of their freight invoices to rigorously auditing 100% of them, saving 6% of their total transportation spend as a result.

The company was founded in 2021 by Matt McKinney and Shaosu Liu. Previously, Matt was a Data Science Manager and a Senior Data Scientist at Uber. Shaosu was a Software Engineering Lead on Uber Freight, where he launched the product and scaled it to 2 billion in annual revenue. Before Uber Freight, Shaosu was on the team that built surge pricing, everyone’s favorite feature.

On the back of their impressive traction and team, Loop raised a $6 million dollar Seed round in 2021 led by 8VC, a $24 million dollar Series A in 2022 led by Founders Fund, and a $35 million Series B this year led by Index Ventures and J.P. Morgan.

Loop has a strong product, excellent traction, and a committed team. They’ve got a vision to become supply chain payments’ system of record and a mission to change how we spend 3% of GDP.

But will they be able to pull it off? Especially given how challenging the logistics industry is?

Well, we think they’ve got a shot.

Let’s dive deeper into why.

The Opportunity

We’ll begin our exploration of Loop like we do for all of our companies, from a first principle:

Large companies lead large, growing markets.

Many startups with great teams and solid growth don’t get very big because there just aren’t enough customers for them to expand into. As a result, we’ll need to show two things:

Loop operates in a large, growing market.

Loop can become a leader in that market.

Market Size

Loop makes money by helping companies process and optimize their freight payments. Since so many companies are spending so much on freight, Loop must operate in a large market.

Simple, right?

While we could stop here, we recognize that wouldn’t make for a very satisfying section.

To us, it makes sense to consider the question of Loop’s opportunity in two parts: how large is the market they’re starting in, and how large are the markets they can expand into?

Initial Market

Shippers initially come to Loop for help optimizing their freight payments. Loop helps them achieve this by:

Automating freight audits, which eliminates extraneous fees and unnecessary spend.

Analyzing payments data, which is important for planning and forecasting purposes.

Surfacing network insights, which helps shippers negotiate more favorable carrier contracts.

How large of a market is this?

One proxy would be the size of the market for freight audits today, largely served by consulting firms and point solutions. Estimates vary, but it seems pretty large: one source puts it at 3.1 billion dollars annually (growing 6.8% each year), and another has it growing to $4.8 billion by 2024.

Another, more principled approach would be to measure the opportunity for for value creation. Loop creates value by helping companies save on their freight operations, a sizable opportunity for a few reasons:

Audits represent a sizable opportunity since freight payments still contain so many errors. The former CEO of Maersk (a far better shipping company than Evergreen) once observed that nearly 12% of container industry invoices are inaccurate, and some have estimated that up to 25% of freight invoices contain an error.

Some of these errors (i.e. having the wrong billing address or rate per mile) can be simple to track down and fix, but others are more complicated. Unplanned detention, demurrage, or per diem fees, unapplied discounts or affiliation savings, freight class errors, customs errors, undiscussed accessorial fees, missed tariff discounts, miscalculated fuel surcharges, miscalculated weights, and incorrect exchange rates can stack up in the background — it’s estimated shippers could recover 2-5% of their total transportation spend through auditing alone.Analytics represent a sizable opportunity since without a clean data layer, they’re so difficult to generate today. There’s an industry trend here: Chief Supply Chain Officers (CSCOs) identified advanced analytics as the second highest priority emerging technology investment, with only 9% reporting no plans to invest. 79% of CSCOs are developing training to drive the adoption of these analytics within their organizations.

Very few supply chain organizations have the data foundations needed to accurately represent their transportation networks. The one Loop has built can help shippers better understand which carriers to prioritize in a region, which areas to expand into, and which bottlenecks exist in their transportation networks. All of these things can have a huge impact.

If this sounds familiar, you might be reminded of the last company we covered, SmarterDx (who also might’ve just raised another round). They do something similar, leveraging domain-specific artificial intelligence to correct errors in hospital documentation. Similar to Loop, this eventually helps hospitals recover lost revenue, improving their bottom lines.

Adjacent Markets

For their audit and analytics products, Loop had to build a first-of-its-kind, robust and extensible data layer allowing shippers to digitize, centralize, and organize all their payments-related data.

It’s this data layer that uniquely positions Loop to eventually expand into other finance and operations-related workflows. Being a shipping organization’s financial system of record makes it easy to expand into the broader, 20.24 billion dollar logistics and supply chain software management market, which just happens to be the fastest growing market in enterprise application software.

For instance, Loop might expand into:

Supply chain financing. In the status quo, invoices take 30 to 90 days to pay. Supply chain financing enables carriers to get paid early in exchange for a small discount (usually 2-3%) on their bill. How does it work? In an example case, a financier might pay the carrier 98% of their invoice upfront. The shipper will then pay the financier 99% of the carrier invoice on the day it’s due, allowing the financier to keep the 1% difference as profit. This is a win-win-win for carriers, shippers, and financiers:

Carriers are in a capital-intensive business. Getting paid early is huge for their ability to operate and expand.

Shippers get to hold their working capital for longer and also get 1% discount on their bill.

Financiers make 1% of the carrier invoice by floating the shipper the funds.

This itself is a swiftly growing market: global supply chain finance volumes are up 21% this year to $2,184 billion, funds in use are up 20% to $858 billion, and revenue is up 23% to $97 billion. This growth has been consistent, and isn’t because of some pandemic-induced surge in freight demand:

Global supply chain finance revenue in billions. Source. Since Loop already handles payments for their customers, they’re perfectly positioned to expand into this market down the line.

Procurement workflows. Shippers span a wide variety of industries (i.e. industrial manufacturing, consumer packaged goods, apparel, financial services, etc.), and many need to procure raw materials to produce their own products. Just as shippers receive invoices from carriers for transportation, they also receive invoices from other shippers for raw materials. Like with carriers, these invoices must be audited and paid, and like with carriers, this is a laborious and antiquated process. Since Loop is already helping shippers with their freight audits, they’re perfectly positioned to start helping shippers with their procurement invoices and workflows also.

Loop’s ambition is to eventually handle everything at the intersection of freight and finance — to be wherever money flows in the supply chain.

Again, there’s an interesting parallel to another compound fintech startup here — Ramp. Both companies leveraged products helping customers spend less into platforms centralizing all finance and operations-related data, uniquely positioning each to build downstream finance and ops products for their respective verticals. Similar to how Ramp expanded from cards to help startups with expense management, procurement, working capital, and vendor management, Loop will do the same with shippers.

Aside: Macro Considerations

Before going forward, it’d be unfair not to address the ongoing freight recession and it’s impact on Loop. Logistics startups have had a hard time this year: Flexport’s revenue is down 70%, and Convoy (a former Loop customer) recently shut down. Is it possible that Loop’s market is actually… shrinking?

While the market isn’t exploding like it was during the pandemic-era freight boom, there are a few structural reasons why Loop has continued to grow and why they haven’t been as affected as other shipping startups:

Flexport and Convoy are different types of businesses:

Flexport is a freight forwarder, meaning they arrange the transportation of goods on behalf of shippers. They handle tasks like storage, customs clearance, and documentation.

Convoy is a freight broker, meaning they act as an intermediary between shippers and carriers. They help negotiate transportation rates and coordinate the logistics of pick-up/delivery.

Both were hurt by the drop in rates caused by the freight recession, which directly impacted their margins. In contrast, Loop is more of a pure software company with a software business model and software margins.

Loop’s primary value propositions are cost and labor savings, both of which are top-of-mind for shippers and 3PLs during recessionary environments. For 3PLs in particular, the pressure to drive operating efficiency and increase working capital amid compressing margins actually leads them to solutions like Loop, which is why they’ve been growing quickly amongst this market segment.

Freight boom and busts have been around since the Motor Carrier Act of 1980, which removed federal entry controls on interstate trucking and made it easier for carriers to set their own rates. The current freight recession is nothing new, and will pass like each of the previous ones.

What won’t change, however, is how crucial freight and freight payments are to our economy. They’re not going anywhere — just like the massive shippers and 3PLs that comprise Loop’s core customer base. If Loop can stay the course, now’s an excellent time to rebuild a pretty foundational part of the freight system and larger economy.

Market Share

So we know there’s demand from shippers and 3PLs to help optimize their freight payments. The question now is whether Loop will be their solution of choice.

As a startup, market leadership is a question of gaining market share and defending it. Loop looks promising when it comes to both.

Gaining Market Share

Although product-wise, most of Loop’s functionality is centered around audits and analytics, what really differentiates them is their mastery of data, which happens under the hood.

Like we mentioned earlier, payments-related data in freight is complex and fragmented. The documents involved are often spread across different file

Types like bill of ladings, proof of deliveries, weight and inspection tickets, and packing lists.

Formats like PDFs, JSONs, CSVs, JPEGs, emails, and EDI 210 transaction sets.

Sources like APIs, EDIs, TMS integrations, ERP integrations, treasury partners, and various external data sources (i.e. fuel rates from the Department of Energy, mileage from PC Miler).

As a result, shippers often outsource the audits and research they need to different consulting firms or specialized SaaS tools. For most, the complexity of the data involved means it’d be too cost and labor-intensive to do in-house.

But this sort of outsourcing is a surface-level solution to a much more fundamental issue: it’s way too difficult for shippers to access their own data .

By centralizing and structuring this information for their customers, Loop solves this underlying issue. By

Digitizing shipment data (allowing users to store any document from any system)

Linking shipment data (allowing users to standardize, assign, and group data across carriers and documents)

Analyzing shipment data (allowing users to search, explore, and export enriched data across carriers and geographies both in aggregate and at the line-item level)

Loop empowers shippers to do anything with their data more easily, not just audits. Compared to outsourcing, this more foundational approach is like curing the disease instead of just treating its symptoms.

The ability to drill into spend at the network, carrier, accessorial, and invoice levels is on it’s own a killer feature, but Loop builds on top of it with best-in-class audit and analytics functionality:

Audits - on top of automatically identifying/root-causing discrepancies between invoiced and expected costs, Loop also automates exception management - addressing missing documents, mismatched rates, and unexpected accessorials.

Analytics - on top of allowing users to analyze their data on their own, Loop also automatically surfaces insights to help with carrier performance or contract negotiations. They even offer a scenario planning tool where you can simulate different network scenarios for cost-effectiveness and efficiency.

A consulting firm or point solution might be able to tell you why an invoice is off, but it won’t address why that audit was so difficult to do in the first place. And it definitely won’t help you search for the same mistake across other invoices for use in next month’s contract negotiations.

On top of these two core functions, Loop has begun vertically integrating a series of other products. This works since customers already trust Loop as a source of truth.

For instance:

Loop automates the end-to-end payment process for shippers, handling everything from cost allocation based on accounting rules/scheduling/aging to the actual payments and invoices.This means when a $1000 freight invoice is processed, Loop's system automatically allocates specific amounts to distinct account codes in the company's general ledger (i.e. $100 to INBOUND.013.4044, where INBOUND means inbound freight, 013 is the facility location, and 4044 is the business unit.

Loop has begun offering supply chain financing with a Quickpay product. The control they have over shipper data gives them a major advantage when it comes to underwriting these sorts of arrangements.

Loop is building functionality to help 3PLs automate accounts receivable workflows, the process where they generate invoices for shippers based on the invoices received from carriers. This is also a relatively complex and manual process today, but Loop is in the process of automating it.

So to recap, how does Loop get shippers to choose them over the consulting firms and point solutions they’re using today? It’s a few things:

Loop is the only solution helping shippers organize their underlying data. By giving shippers control over it, they’re actually addressing the root issue.

Loop is more than just a point solution. Beyond audits, their sophisticated data layer enables everything from rules-based cost allocation to scenario planning to automated insight generation.

More than just helping shippers save money, Loop is fundamentally improving how they consume and use data.

Defending Market Share

Now that we understand how Loop’s been gaining market share, let’s consider how they can keep it. It’s still early days, but Loop has several moats they’ve been building into their business:

Switching costs. By centralizing/structuring all this previously unstructured data and by owning core workflows like payments, audits, and forecasting, Loop becomes the default system of record for anything finance-related in freight. It becomes really hard for shippers to move off of Loop since every function (i.e. finance, accounting, operations) relies on the data they uniquely control.

Technology. Bringing structure to all this data is a difficult technical problem. Parsing is hard since computer vision and natural language processing only recently got good enough to ingest all the different files and file types Loop deals with. Domain modeling is hard since each carrier generates their own agreements and rate contracts, meaning there’s an infinite number of rules around how much a shipment should cost.

Loop has technical depth along each of these axes, leveraging proprietary models trained on proprietary data and a sophisticated domain representation for their core products. This moat gets wider with time: as Loop collects more data for their models and discovers more rules to include in their system, it gets harder and harder for new players to catch up.

Platform effects. Loop can share anonymized insights around carrier contracts, rates, and performance across shippers to help users improve their own transportation networks. The more shippers join the platform, the more valuable Loop becomes in this regard.

Competitive Landscape

Loop is a transformative player in the world of freight payments, but they’re far from the only company in the space. Now that we’ve got an understanding of Loop’s unique strengths as a product and company, let’s see how they stack up against their competitors.

Freight Audit Firms

Audit firms are the traditional solutions in the space. Like Loop, they help shippers with payments, audits, and analytics, but they do so in a consulting capacity.

There are many players here, but a few examples would include ShipSigma, Trax Technologies, and ARTC Logistics. Each of these firms relies on a dedicated team of consultants for tasks Loop has automated with AI — ShipSigma, for instance, assigns personnel to audit freight invoices for clients while ARTC Logistics can be commissioned to conduct “What-If” rate analyses assessing the impact of carrier rate changes.

Compared with these players, Loop has several things going for it:

Automation makes them faster, more comprehensive, and more accurate than any human audit team. No traditional firm could ever offer near real-time audits or insights like Loop.

The data layer they’ve built addresses the root cause for outsourcing in the first place. With Loop’s data, that “What-If” analysis could be done with a spreadsheet in-house.

Loop isn’t limited by their employee count. Software allows Loop to scale with zero marginal costs, unlike the companies here.

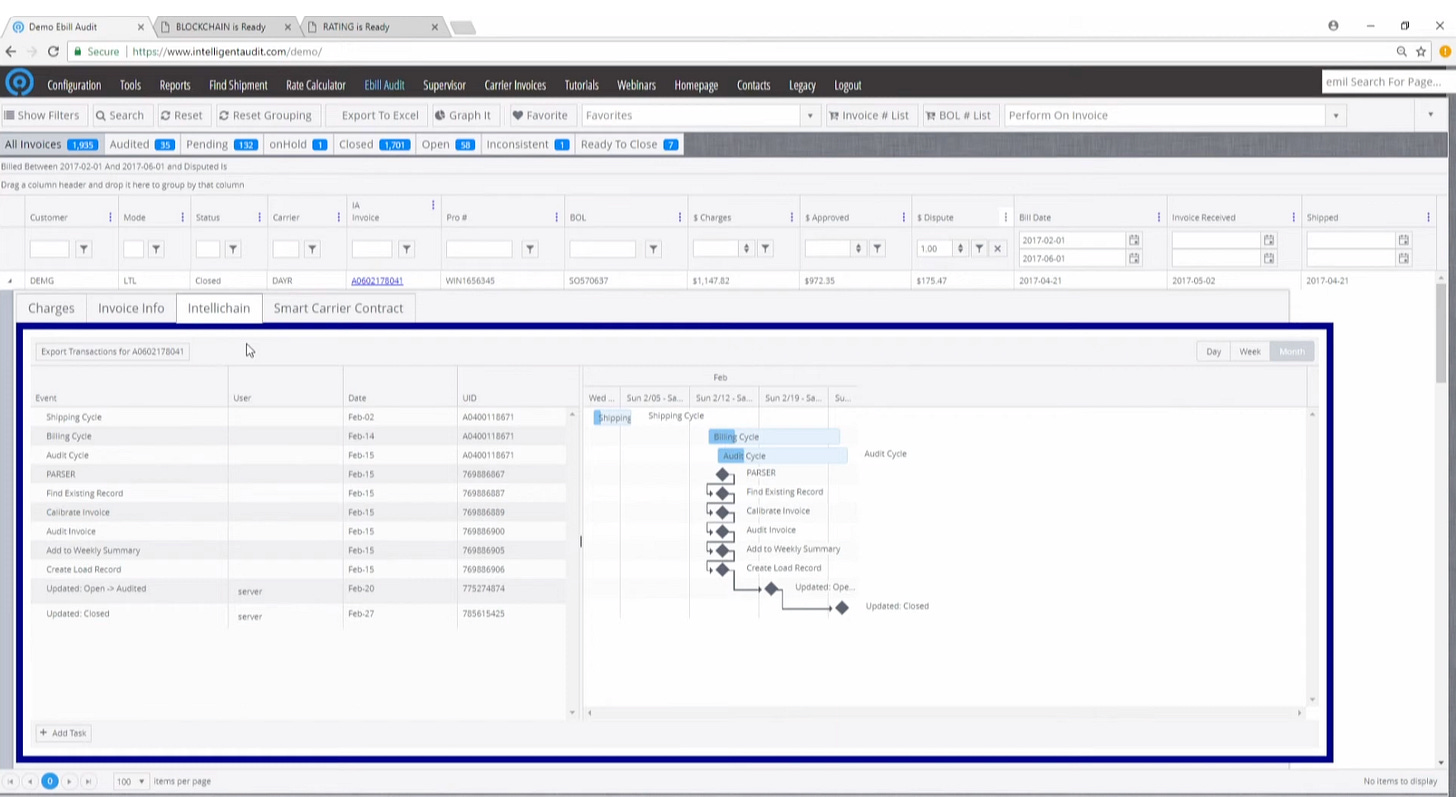

Freight Audit Software

Next, there are a number of companies offering more technically oriented products. Like Loop, they help shippers with payments, audits, and analytics, but they do so with a number of point solutions that don’t address the underlying problem of data integrity.

Some notable players in the space include Shipware, OpenEnvoy, and Intelligent Audit. Some have grown quite large: Intelligent Audit, for instance, is almost 30 years old and processes over 20 billion in payments each year.

While these firms also provide tools to help shippers audit their invoices, they fall short of Loop in several important ways:

Product-wise, they’re brittle point solutions. While they might automate audits for a specific contract from a specific carrier whose data they have a specific integration with, they don’t generalize like a human or AI auditor would. Why?

Because product-wise, they lack the robust data foundation Loop has. Like consulting firms, this prevents them from addressing the root issue of data integrity/accessibility. This also prevents them from expanding into more sophisticated offerings, like analytics or automated insight generation. Why?

Because technology-wise, these companies don’t have much going on. A lack of machine learning talent (we stalked each company’s LinkedIn profile) makes it unlikely they could build an ingestion system like Loop. An outdated stack and probable mountain of technical debt means it’s unlikely they’ll ever get that talent.

Financial Services Companies

Finally, there are a few banks and financial services companies that bundle audits into the freight finance services they primarily offer. Some major players here include US Bank (the fifth largest bank in the country) and Cass Information Systems. These firms also operate as consultants, giving them the same drawbacks as the traditional audit firms we looked at earlier. In addition, they also suffer from a lack of focus: since their main business isn’t freight (and even in freight their main business isn’t audit or analytics), they have little pressure to improve their data, audit, or analytics-related offerings.

These will be more direct competitors when Loop expands their footprint in freight financing, but even then Loop’s control of data will give them the advantage when it comes to things like underwriting.

Execution

Loop has redefined how shippers work with payments data, but they eventually want to handle everything at the intersection of freight and finance.

It’s an ambitious vision, but Loop’s built a team with both the engineering and operational chops to pull it off.

Consider a sampling of their roster (they have lots of people from Uber Freight and Flexport):

Matt McKinney - Co-Founder, CEO

Matt was previously a Data Science Manager and a Senior Data Scientist at Uber. Before that, he was a Founding Data Scientist and Software Engineer at MakerSights. He holds a BS in Industrial & Systems Engineering from USC.

Shaosu Liu - Co-Founder, CTO

Shaosu was previously a Software Engineering Lead at Uber, where he launched and scaled Uber Freight to over $2 billion in annual revenue. He holds a BS in Mathematics and Computer Science from UIUC.

Anastasia Fullerton - Head of Marketing

Anastasia was previously Head of Marketing at Extend (last valued at $1.6 billion). Before, she was a Senior Product Marketing Manager at Amplitude and a consultant at Accenture. She holds a BS in Management Science & Engineering from Stanford.

Heidi Yang - Head of Product Design

Heidi was previously Product Design Lead for Load Logistics at Uber Freight. Before, she was a Product Designer at Intuit. She holds a BS in Entrepreneurship and an MS in HCI from Carnegie Mellon.

Lauren Oliver - Head of Customer Success

Lauren was previously GM, Money Operations at Uber Freight. Before, she was a Key Account Manager at C.H. Robinson. She holds a BA in Political Science from UIUC.

Max Heinritz - Software Engineer

Max was previously a Senior Staff Software Engineer at Flexport, where he was tech lead for transportation automation. Before, he was a Software Engineer and Product Manager at Google. He holds a degree from UPenn.

Cody Krainock - Software Engineer

Cody was previously a Software Engineer at WhatsApp and a Software Engineering Manager at Flexport (engineer #13).

Sean Nicolay - Software Engineer

Sean was previously a Staff Software Engineer at Flexport and a Software Engineer at Facebook. He holds a degree from UIUC.

Matthew Ebeweber - Software Engineer

Matthew was previously a Software Engineer at Instagram and a Senior Software Engineer at Flexport. He holds a degree from UT Austin.

Paul Scheid - Software Engineer

Paul was previously a Senior Software Engineer at Flexport. Before, he was a Software Engineer at Wolverine Trading. He holds a degree from WashU.

Kevin Cai - Software Engineer

Kevin was previously a Senior Software Engineer at Flexport. He holds a degree from the University of Waterloo.

Sam Eastwood - Business Operations

Sam was previously Chief of Staff and manager of the Shipper Operations team at Uber Freight. He holds a degree from Northwestern.

Zach Negroni - Senior Account Executive

Zach was previously an Enterprise Account Execute at Samsara and a Corporate Account Executive at Box. He holds a degree from Boston College.

Tom Zidar - Senior Data Scientist

Tom was previously a Senior Data Analyst at Uber Freight. Before, he was a Data Scientist at Motive (aka KeepTruckin, last valued at $2.85 billion). He holds a degree from UMich.

Simon Demertzis - Solutions Engineer

Simon was previously a Senior Solutions Architect at MongoDB. Before, he was an Account Partner at Slack and a Director of Solutions Engineering at Decision Engines. He holds a degree from Northeastern Illinois University.

Will Taft - Software Engineer

Will was previously a Software Engineer at Composable Analytics. He holds a degree from Yale.

Evan Richards - Software Engineer

Evan Richards was previously a Senior Software Engineer at Uber. He holds a degree from MTSU.

Jack Taylor - Software Engineer

Jack was previously a Software Engineer at Rakuten. He holds a degree from Davidson.

Shin Thu San - Product Manager

Shin was previously a Product Manager at Block, Vanta, and Flexport. She holds a degree from UC Berkeley.

Shuwei Chen - Product Manager

Shuwei was previously a Product Manager at Isometric Technologies and Flexport. He holds a degree from UCLA.

Christina Danita - Software Engineer

Christina was previously a Software Engineering Intern at Athelas. She holds two degrees in CS from Stanford.

Grace Lee - Software Engineer

Grace was previously a Software Engineering Intern at Gusto. She holds a degree from Brown.

Conclusion

If Loop succeeds, the world of freight will essentially have its first automated clearing house — paying for a truckload of Coke will be as simple as buying a bottle of it at the store yourself.

Freight might be one of the most complex industries on Earth, but paying for it doesn’t have to be.

They’re hiring.

Thanks to Wes Friedman and Vivek Gopalan for their help with this piece.

In case you missed our previous releases, check them out here:

And to make sure you don’t miss any future ones, be sure to subscribe here:

Finally, if you’re a founder, employee, or investor with a company you think we should cover please reach out to us at ericzhou27@gmail.com and uhanif@stanford.edu - we’d love to hear about it :)

His name selvaraj

Nice piece, very insightful!