Why You Should Join Meter

The next modern utility.

Some opportunities to consider:

Meter just raised a sizable round from Sam Altman and Lachy Groom after more than tripling revenue, square footage, and deployed networks. They’re actively hiring for several functions, including a number of engineering, product, and GTM roles that aren’t yet publicly listed. Reach out to jobs@meter.com if you’re interested in any roles not on their website.

Etched has built a chip that can run transformers >10x faster than GPUs. They’re currently hiring Machine Learning Researchers, Compilers Engineers, Verification Engineers, Firmware Engineers, RL Design Engineers, interns, and more in Cupertino.

Welcome to “Why You Should Join,” a monthly newsletter highlighting early-stage startups on track to becoming generational companies. On the first Monday of each month, we cut through the noise by recommending one startup based on thorough research and inside information we’ve received from venture firms we work with. We go deeper than any other source to help ambitious new grads, FAANG veterans, and experienced operators find the right company to join. Sound interesting? Join the family and subscribe here:

Why You Should Join Meter

(Click the link to read online).

Do you remember the last time you got mad at your computer?

Like really mad.

Maybe you accidentally refreshed a web form and lost all your progress. Maybe you were on an important Zoom call and it kept cutting out. Maybe you were watching a movie on Netflix and it wouldn’t stop buffering. Maybe you were trying to withdraw from FTX.

If you’re like most people, though, chances are it had something to do with slow internet.

There isn’t much that gets more people worked up.

A man in Singapore recently tried to strangle his landlord over slow Wi-Fi. A man in the Philippines used a hammer to smash his router for the same reason. A 90-year old in America recently spent $10,000 on 2 ads in the Wall Street Journal to tell the CEO of AT&T his internet sucked, complaining that streaming a movie on Roku was like watching a “slideshow.”

Enough people have complained about Comcast, the largest home internet service provider in the country, that they at one point had a lower customer satisfaction rating than the IRS.

While we can’t condone shooting your computer or throwing it out a window when your video keeps buffering, we also can’t downplay the importance of good Wi-Fi these days. The way things work today, having crappy internet impacts everything from

Education - students without home internet access are usually half a GPA point below students with access. This ripples out to longer-term impacts on academic ability, college admissions, and career opportunities.

Economics - a 2010 study of OECD countries found doubling broadband speed has the effect of boosting GDP growth by 0.3% a year. In the US, average broadband speeds going from 10 Mbps in 2010 to 174.2 Mbps in 2020 had the effect of boosting GDP by $1.3 trillion.

Health - 10% of UK adults experience stress due to slow or unpredictable internet connections. One study found delays when streaming video can increase heart rates by 38%, and another found almost half of people lose their temper over laggy (>60 second delays) technology each week.

With the internet now serving 66.2% of the global population and handling 456 million terabytes of traffic a month (a figure that’s growing 20.5% each year), we rely on it for enough things that last year, the UN High Commissioner for Human Rights said “it may be time to reinforce universal access to the internet as a human right.” A few months later, the chair of the FCC agreed, proposing rules that would reclassify broadband access as an essential service like power or water.

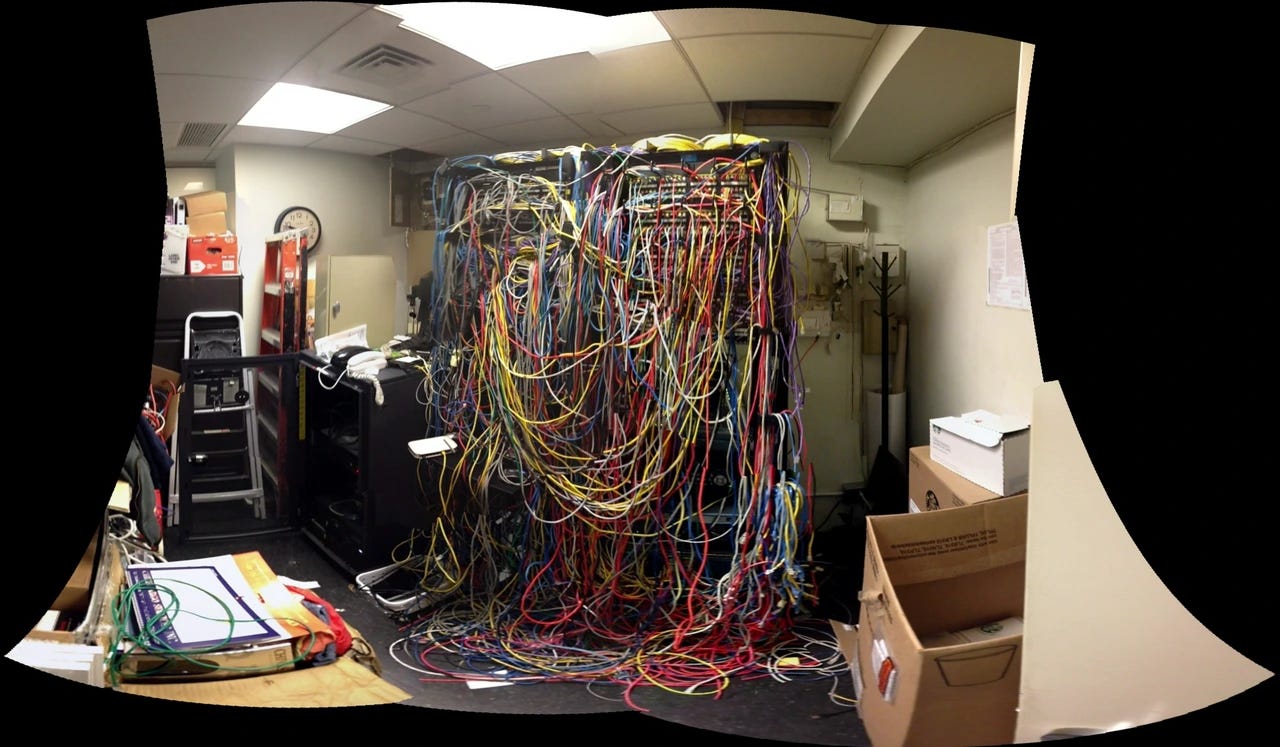

But if there’s a reason networks aren’t as reliable as power or water, it’s because they’re not nearly as easy to set up and maintain.

Especially for the larger ones you’ll find in schools, offices, and warehouses, networks are harder to manage for a few reasons:

Nothing comes pre-installed. Wi-Fi isn’t like power or water, which comes ready with any space you’re moving into. The complexity, cost, and customizability of networks means they’re almost always left to individual tenants to set up. The choice of provider, network design, capacity requirements, security requirements, hardware, management tools, etc. are all things companies have to decide on, implement, and maintain themselves.

There are more moving parts. Running a network means picking an ISP, acquiring the right hardware, running cable, installing/configuring that hardware, troubleshooting issues, and upgrading/scaling things as needed. There are many more vendors, parts, and stakeholders involved than with traditional utilities.

They are dependent on your specific space. The design of your network depends on the physical layout of your building and where your devices will be located. A warehouse with racks and robots will need a different network than an office with desks and meeting rooms, even if the square footage is similar. You have to account for things as specific as not putting access points near microwaves, elevators, or bathrooms.

If you’ve ever set up a network yourself at home, you know how much fiddling is needed to get things working right. Imagine how much worse it is when you’re doing it for orders of magnitude more people across orders of magnitude more space, especially if you still don’t have much networking experience.

For something so important, it’s surprising that the experience of setting up and managing a network hasn’t been more abstracted away — the way every other essential utility has.

This, in a nutshell, is what Meter is trying to do.

Background

Meter offers a fully-managed network as a service.

In the status quo, moving into a new office, warehouse, or school means setting up a network from scratch. This means finding and negotiating with ISPs based on your bandwidth requirements, designing a network based on your floor plan, picking and procuring routers/switches/access points based on your design, and installing/configuring/testing everything at the end. After setup, maintenance means troubleshooting issues as they come up (i.e. why did my Zoom call drop?), tuning and optimizing your network in response (i.e. realizing it’s because there are too many devices on that AP’s frequency band), and adding security measures as needed (i.e. DNS filtering or Firewalls). For organizations without network engineering expertise, this means hiring a constellation of consultants, Managed Service Providers (MSPs), and subcontractors — or a lot of pain for their own IT team.

For these organizations, Meter offers what’s essentially a network in a box. For a flat monthly fee, they’ll handle everything from setup to maintenance to support, using their own hardware, software, and staff to make it happen. In doing so, Meter abstracts away everything related to:

Setup. This includes ISP procurement & installation, custom network design, hardware provisioning and installation, low voltage cabling, full IT closet/server room buildouts, testing and configuration, site surveys and project management - everything needed to get the network running.

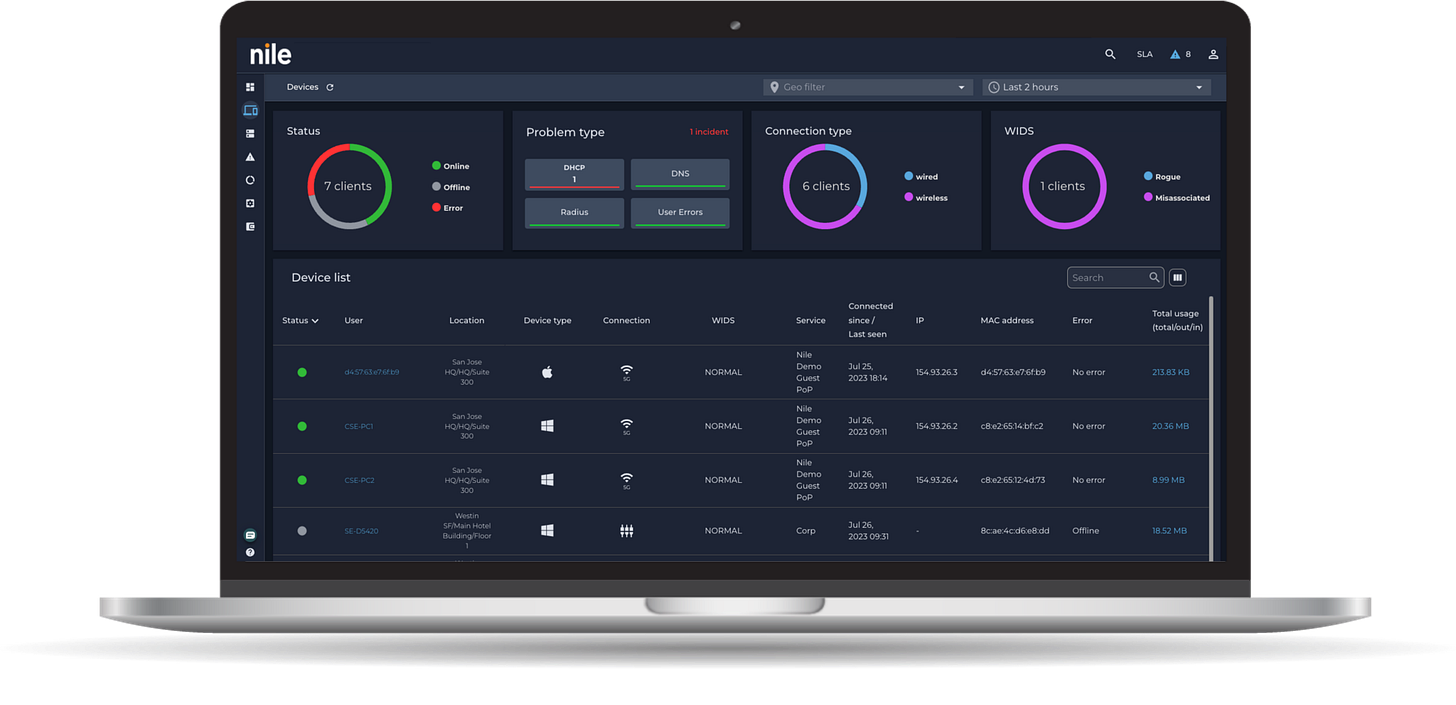

Maintenance. This includes preemptive network management/optimization, cloud dashboards for manual troubleshooting, and ongoing support/maintenance via a 24/7 operations team which helps with network outages, growth/scaling requirements, and config management/updates - everything needed to keep the network running.

Enabling this is a proprietary hardware (security appliances, switches, routers, and access points), software (dashboard, security tools), and firmware stack developed by Meter in-house. By achieving complete vertical integration — both producing their own technology and installing/managing it — Meter has more control, visibility, and understanding of their client networks than a vendor who just made the hardware or an MSP who just installed it ever could.

Concretely, this has allowed them to create value over traditional service providers in two ways:

Better service. Meter isn’t just there when you file a ticket - their complete understanding/control over your network means they’re continuously optimizing it based on usage patterns to prevent issues in the first place. Having one party behind your hardware, network design, and maintenance also makes it easier in case you do need to escalate - there are no information siloes to overcome.

Better pricing. Beyond eliminating upfront capital costs, Meter is actually cheaper than buying hardware separately and working with MSPs to install/maintain it. The fewer middlemen, incident prevention, and more efficient incident resolution enabled by vertical integration allow Meter to offer their flat pricing model while still maintaining strong margins.

Meter’s flat monthly fee is truly flat - they charge per square foot per month, making them more similar to S3 than traditional hardware vendors. Everything from hardware upgrades to network design to installation is included in their subscription — there are no one-off, special costs. In many cases, their pricing is even easier to understand than traditional utilities.

Meter was founded in 2015. After spending a few years developing their own hardware and software stack, the company began rolling out their first few deployments in 2019. The company has grown rapidly since - Meter was working with hundreds of customers by 2022 and has more than tripled revenue, square footage, and deployed networks since. Today, the firm serves tens of millions of square feet and supports customers across all industries: startups like Brex, real estate companies like Tishman Speyer, and entire school systems like Higher Ground Education’s 165 locations all rely on Meter for their networking. Customers love them: GoBolt, a fulfillment and logistics company, reduced their total networking costs across 14 fulfillment centers by 25% with Meter. Other IT teams have reported an 80% decrease in support tickets. A Director of IT & Security told us switching to Meter for his unicorn company’s new headquarters was a “no-brainer.”

The company was founded by brothers Anil and Sunil Varanasi. Anil studied network engineering in college, and while in school started a sizable business building network systems with his brother. After selling the business, the two realized there was an opportunity to re-imagine the networking experience from the ground up, stemming from personal pain points setting up all those networks. Deciding to start with the hardware, the two moved to China for a month to begin experimenting with that. They ended up staying for a full year.

To fuel their recent growth, Meter just raised a fresh $35 million dollars from Sam Altman and Lachy Groom. Previously in 2022, they had raised a $38 million dollar Series B from Sequoia and Lachy Groom. Before that, they had raised a $12 million dollar Series A, also from Sam Altman and Lachy Groom. Along the way, they’ve also assembled quite the roster of angels: Reid Hoffman (LinkedIn), Diane Green (VMWare), Sanjit Biswas (Meraki/Samsara), Tobi Lutke (Shopify), David Solomon (Goldman Sachs), Egon Durban (Silverlake), and the Collison brothers (Stripe) are all investors. As it turns out, the pain of network engineering is something almost anyone can empathize with.

Meter has a strong team and a sophisticated offering that, for the first time, promises to take all the pain out of running an enterprise network. Their mission is to make Wi-Fi as much of a utility as power or water — something you can just turn on or off when you move into a new office.

Will they be able to pull it off?

Networking is one of the biggest markets in all of technology. It’s a tough, crowded space with a lot of players, none of which have been able to offer the experience Meter’s promising so far.

Well, we think they’ve got a shot.

Let’s dive deeper into why.

The Opportunity

We’ll begin our exploration of Meter like we do for all of our companies, from a first principle:

Large companies lead large, growing markets.

Many startups with great teams and solid growth don’t get very big because there just aren’t enough customers to grow into. As a result, we’ll want to show two things:

Meter operates in a large, growing market.

Meter can become a major player in that market.

The Market

Meter operates in the market for enterprise network hardware and services. They make money when companies who need help with an office, warehouse, or in-store network outsource those needs to Meter. Since every company needs a network but relatively few have the network engineers to support it, Meter must operate in a large market.

Simple, right?

Well, we can be a bit more precise.

While Meter serves businesses of all sizes and industries today, the customers who most strongly feel a need for their services are mid-market to enterprise firms with small IT teams but multiple site locations - think a large university system, clothing brand, or tech company, all of whom we’ve seen Meter serve. These are the companies that want their internet to just work, but don’t have the resources to work on it.

Today, most of these organizations are working with one or several managed service providers (MSPs) and hardware vendors to help design, implement, and maintain their network. As the purest proxy for Meter’s market, then, we might ask how much businesses are spending on such managed service providers today.

Empirical estimates vary, but people generally agree it’s a lot:

One estimate suggests global annual spend on Managed Network Services will grow from $65.7 billion in 2023 to $89.9 billion in 2028, at a CAGR of 6.5%. Another suggests global annual spend on the broader Infrastructure Implementation and Managed Services category was $318.2 billion in 2022. Another valued the even broader global IT Managed Services market at $472 billion in 2023, up 12.7% from from $419 billion in 2022.

A survey of 1,400 IT professionals across North America, EMEA, and Latin America found managed services was the only budget category that grew between 2021 and 2023, rising from 16% to 18% of total IT spend - hardware, software, and cloud-based service spend were all proportionally down.

In 2024, 84% of MSPs predict revenue to increase, with 77% predicting profit to increase also. A survey of 500 MSPs found average MSP revenue grew from $8.93 million in 2021 to $12.25 million in 2022, with the average one forecasting further growth to $16.29 million in 2023.

At a higher level, overall spend on IT services continues to grow, jumping 8.7% from 1.38 trillion in 2023 to 1.5 trillion in 2024. Notably, this is greater than the 6.8% overall IT spend is projected to grow at - across nearly every industry, CIO spending for managed services is growing faster than internal spending on IT talent, which is approximately 3%. With salary growth expectations closer to 6%, it’s clear that companies are spending more money on fewer employees and outsourcing the rest: Gartner predicts spending on consulting for IT work will grow by 10% to 15% across almost every industry this year. The market for outsourced IT help was already big, but broader industry trends mean MSPs (and Meter) are absolutely feasting right now.

But Meter is far more than your typical MSP: they also make their own hardware.

As a result, Meter is competing with traditional vendors (Cisco, Juniper, Aruba) in the network hardware market as well. This, too, is a sizable opportunity: one estimate has the global Enterprise Network Equipment market growing from $72.44 billion in 2024 to $124 billion in 2029, at a CAGR of 11.35%. Another estimate has it growing from $101 billion in 2023 to $133 billion in 2027, at a CAGR of 9.1%.

Network as a Service

More broadly, the trend Meter has helped define and lead is that of “Network as a Service” — offering customers a complete, consumption-based package of hardware and services that abstracts everything else away. Beyond being lower-overhead for organizations without networking expertise, NaaS’s benefits include better pricing, quicker deployment, and easier scaling.

The numbers on NaaS are early and less well-defined, but still promising nonetheless:

One report suggests NaaS will be adopted by 15% of all enterprises by the end of 2024, up from less than 1% in 2021. Another found that 49% of IT leaders are planning or considering a NaaS transformation for their organization, with 69% of interested groups planning to invest within 12 months. A third found that 47% of enterprise technology leaders planned to adopt NaaS, with 10% saying they had transitioned already and just 14% saying they had no plans to transition at all.

With regards to benefits, one survey found that 76% of companies thought NaaS could help reduce operations costs, 60% thought it could enable a shift from CapEx to OpEx, 65% thought it could help enhance security, and 57% thought it would free up time for innovation and strategic initiatives. Another survey found 62% of IT leaders were considering it because of enhanced network security, 58% because of optimized network performance, and 48% because of guaranteed service levels. Interestingly, while IT is the department that would most benefit from NaaS, 46% of operations and 40% of engineering teams surveyed were pushing for it also.

As a result of all this, one estimate has the NaaS market growing at a CAGR of 32% to $78.38 billion by 2028.

Tailwinds

The rise of NaaS is a part of this broader growth in managed services/outsourcing we observed earlier.

Why has this been happening?

There are many reasons, but a major one has been necessity - the proliferation of cloud deployments means there just aren’t as many people with networking experience as there used to be:

86% of US-based CIOs expect at least 25% of their network engineers to retire within the next five years. 95% of CIOs have reported that a shortfall of network engineers had led to an inability to manage networks, something which 91% of network engineers agreed with.

More broadly, 59% of IT teams have found it “somewhat” or “very” challenging to find skilled IT talent. IT employment has been gently declining for a while now, at one point contracting for 23 consecutive months between January of 2022 and January of 2024.

Almost by necessity, companies have been outsourcing their network-related responsibilities - it’s often too difficult to hire or retain the people they’d need otherwise. It makes sense why something like Network as a Service would be taking off right about now.

The Strategy

So we know companies are looking for help managing their networks. The question now is whether Meter will be their solution of choice.

Meter’s customers — mid-market to enterprise companies with small IT teams but lots of network to manage — judge Meter based the quality of network they provide and their service in doing so.

In this, Meter competes with both the MSPs these organizations would’ve otherwise outsourced their networking needs to and the vendors those MSPs would’ve otherwise sourced their network hardware from.

Compared with them, Meter’s vertically integrated approach allows them to offer a better service at a better price. Let’s look at how Meter is usually better on both fronts, and why much of it is uniquely enabled by their vertical integration.

Pricing

Working with traditional MSPs usually means paying sizable upfront costs for network design and setup (i.e. for hardware, site surveys, network design, low voltage cabling, etc.), as well as a number of recurring and one-off fees for support, maintenance, and upgrades.

Meter, in contrast, charges per square foot per month, inclusive of hardware, setup, and upgrades — their model involves zero upfront costs.

Why is this approach better?

For one, it’s more predictable. Meter’s pricing allows companies to move network-related costs from CapEx to OpEx, making it easier for IT teams to plan, budget, and procure upfront. Since everything is included, customers don’t have to worry about finding budget for one-off repairs or upgrades going forward either.

More importantly, though, this model also ends up being cheaper.

Most MSPs would charge a premium for the sort of turnkey, project-managed bundle Meter is offering, but Meter has never had a customer where the traditional vendor + MSP combo would’ve been cheaper. Meter has always been more cost effective.

For instance, we went through the numbers with one IT director who was deciding between Meter and some MSPs for their new, 40 thousand square foot office in San Francisco. Compared with what the MSPs were quoting for setup alone — not even including annual fees for support, maintenance, and upgrades — Meter’s first year price was already 5x lower. Faced with a >5 year breakeven and the prospect of avoiding a sizable upfront capital commitment, going with Meter was a “no-brainer”.

How is this possible? Is Meter just another startup getting subsidized by VCs?

It’s because they handle everything themselves.

Meter’s able to beat everyone on price while maintaining margins because with them, you aren’t dealing with a large number of vendors, subcontractors, and middlemen, each with their own hidden costs/fees/margins to take care of — since Meter builds their own hardware/software/firmware stack, they don’t need to work with anyone else. Additionally, since they design their own networks and deploy their own hardware, support (upgrades, resolving tickets, etc.) can be offered far more efficiently — Meter is already an expert on the networks of all their clients, and there are no knowledge silos to be broken down.

Another reason is the growing way they’ve been acquiring customers.

When Meter customers move to new spaces, they leave their old Meter setups behind. Then, when new companies move in, instead of going through the pain of setup, all they have to do is call to turn things on — just like a traditional utility. Meter has already acquired dozens of customers this way, and it’s brought customer acquisition costs down significantly.

In some deeper sense, when setting things up Meter acquires both the customer and the space itself. Owning the space is a durable advantage compounds with time — we see it becoming an interesting moat of sorts in the future. Physical network effects (i.e. railroads, telephone lines) are the strongest moats in business, and Meter is starting to build one.

Services

Working with traditional MSPs usually means hiring separate groups or sub-contractors for different network-related subtasks — think network design, cabling and installation, upgrades, or network security. Meter, in contrast, offers an integrated service with installation, support, optimization, and management all covered — instead of dealing with several parties, you only deal with one.

Why is this approach better?

Having one owner for everything makes resolving issues much more efficient. If the MSP helping maintain your network isn’t familiar with a design or hardware choice made by a different party, it becomes much harder for them to troubleshoot an issue potentially stemming from it. With good MSPs this will result in a longer resolution time, but with bad ones this can result in blame games between the vendor, the configurator, and the ISP, where no one party wants to take ownership.

Since there are no such knowledge or ownership silos in a network managed by Meter though, this isn’t an issue.

More concretely, Meter’s vertically integrated approach improves support on three levels:

Preventative maintenance. Traditional MSPs operate reactively, making changes and improvements when they receive complaints or network alerts from the tools they use — a.k.a when something breaks. In contrast, Meter operates proactively, preemptively optimizing network designs and infrastructure with software to avoid failures in the first place. For instance:

If an access point goes out, the system is immediately alerted to increase the strength of a neighboring access point.

Wi-Fi channels are automatically adjusted to prevent overlap, and transmit power/bandwidth are automatically adjusted to optimize connectivity.

When upgrading the network from WiFi 5 → WiFi 6 → WiFi 7 (as Meter customers will have experienced from 2022 → 2023 → 2024), Meter’s system automatically readjusted the physical layout and software configurations of access points to optimally use the benefits of the new standards and hardware.

Meter is constantly improving their network’s “operating system” in this way. As a result, some customers have seen an 80% drop in tickets since switching over.

Self-maintenance. When there’s a need for it, Meter’s software also makes it easier for customers to adjust and fix things themselves. Since there’s a direct line of feedback between Meter’s end-users and Meter’s engineers (in contrast to traditional vendors, who are separated from end-users by MSPs), Meter can build features and adapt things in response to common feedback. For instance:

When expanding into the education market, Meter heard from many users about the importance of content filtering (i.e. preventing students from using TikTok). In response, Meter worked with Cloudflare to launch a DNS Security feature. Previously, IT teams would’ve had to use a separate vendor for this, but now, Meter customers could simply can turn it on within their dashboard, no extra contracts or payments required.

Similarly, many Meter customers manage a number of sites remotely — think a large brand with many storefronts, each with their own networks. For these customers, the ability to understand, reconfigure, and root cause issues while remote was very important. In response, Meter developed their “digital twin” concept - a fully virtualized version of a network that’s updated in real-time, down to individual ports and switches. In addition, they went and added backup LTE antennas to their controllers so that even if ISP circuits went down, things could still be accessed remotely. If you’ve ever wanted to visit an IT closet through a web browser, this is the closest you’re going to get.

Support-led maintenance. Between their ownership of the entire service stack (ISP relations, network design, network setup, network maintenance) and the entire product stack (hardware, firmware, software), Meter is more familiar with the networks of their clients than any MSP or vendor ever could be. As a result, this makes it more efficient for Meter to diagnose and fix issues that have been escalated to them. For instance:

If a laptop has an issue related to Wi-Fi, Meter customers typically just give Meter that computer’s address. Since Meter’s support team has access to unified logs across every level of the stack, they’re able to troubleshoot what happened with the laptop’s connection relatively easily. This is much faster than the IT team parsing log events and stitching together interpretations themselves.

In the Fall of 2022, Meter had an uptick in customers complaining about slow internet connection and dropped Zoom calls. Meter’s QA and engineering teams weren’t able to find any issues in Meter hardware and software. Since Meter manages hundreds of networks though, they were able to quickly diagnose that the issue was specific to Macbooks and push an interim fix for their customers. The root cause was an update Apple pushed causing Macbooks to use AWDL (Apple Wireless Direct Link), a Wi-Fi interface which caused connections to periodically reset.

The end of the last point is worth double clicking on: MSPs offer a lot more than just network services and often don’t specialize in them. Instead, they help clients with many different IT-related tasks, from managing security to SaaS tools to compliance. In fact, 85% of MSPs planned to add between 1 and 8 of services last year, with the average adding 5 overall.

In contrast, Meter only does networking.

Competitive Landscape

Networking is one of the largest markets in all of tech.

Now that we have an understanding of Meter’s unique strengths, let’s see how they compare against potential competitors.

Hardware Vendors and MSPs

We’ll start by focusing on the vendors and MSPs people today are outsourcing their networking needs to.

Vendors are the firms that provide the hardware — think Cisco, Juniper, Aruba, Arista, Fortinet, and Ubiquiti. These firms produce the routers, switches, access points, and controllers needed for networks to run, as well as the software needed for IT teams to manage them. They usually sell their products directly or via channel partners, leaving their configuration and implementation up to the MSPs or IT teams actually in charge of designing and installing the network.

MSPs are the firms that provide the service. They generally operate more locally — the SF Bay Area, for instance, has TruAdvantage, ZAG Technical Services, Parachute Technology, ComputerLand of Silicon Valley, and OneClick Solutions Group, among others. One estimate suggests there are up to 20,000 profitable MSPs in North America.

Since Meter provides both hardware and services, they end up competing with both. To recap how Meter’s vertical integration gives them an edge:

Offering both hardware and services under one roof is more economical - there are no subcontractors or partners with their own fees and margins to take care of. Think Tesla vs Ford.

Compared with vendors specifically, Meter’s vertical integration results in a better alignment of incentives. Traditional hardware vendors are focused on selling boxes, whereas Meter is focused on selling working Wi-Fi. As a result, Meter’s hardware, management software, network designs, and service playbooks all work together to create better outcomes, which isn’t something in scope for traditional vendors.

Compared with MSPs specifically, Meter’s vertical integration results in less siloing of information and ownership. This makes it easier for the provider (Meter) to both proactively optimize networks and to resolve issues that have been escalated to them.

NaaS Offerings

NaaS offerings present a more direct competitor since they (in theory at least) also offer everything under one roof. This isn’t a super crowded market since it takes a lot to offer everything needed to run and continuously support a network — it took Meter several years before they were ready for their first deployment, and several more before they were mature enough for some of their larger customers today. As a result, most of the players here are hardware vendors who already had extensive product portfolios. Let’s have a look at the major offerings.

Nile - this is the main other startup in the space. They’ve raised $300 million in total, including a $175 million Series C last year from March Capital and Sanabil Investments to begin focusing on the Middle East and Europe. Nile is a promising competitor in this new and growing market, and like Meter is growing quickly.

Cisco+, Juniper NaaS, Greenlake - these are the NaaS offerings of traditional vendors. Cisco runs Cisco+, Juniper Networks runs Juniper NaaS, and HPE/Aruba runs Greenlake. Compared with Meter, these offerings:

Aren’t vertically integrated. These firms produce their own hardware, but contract the service component out to MSPs instead of using their own staff. As a result, these NaaS offerings aren’t much more than different payment models — since they’re not vertically integrated like Meter, they lack the pricing and service advantages Meter has. They still have knowledge silos, fragmented ownership, and subcontractor margins to worry about.

Aren’t widely available. For instance, Cisco+ is actually only available for datacenter applications and isn’t actually available for networking yet. Anecdotally, HPE is being “selective” about who they’re offering Greenlake and its NaaS-based pricing structure to.

The issue? All these companies already have sizable market share and are making good money upfront with the current model. As a result, they have no incentive to switch their customers over to a NaaS-based payment plan. Additionally, services are a skillset they don’t have much experience with, which is why they’ve been forced to partner with MSPs. As a result, none of these offerings are as integrated as Meter.

Execution

Meter has a strong, diverse team working together to build the future of networking. Consider a sampling of their roster:

Apurv Bhartia - Head of Wireless

Apurv was previously a Senior Engineering Manager at Cisco Meraki. Before that, he was a Research Intern at Microsoft and a Software Engineer at Huawei. He holds a Ph.D. in Computer Science from UT Austin.

Nilesh Hirve - Head of QA & Technical Support Engineering

Nilesh was previously a Director of Software Engineering at Cisco Meraki. He holds an M.S. in Telecommunication and Network Management from Syracuse University.

Abhijeet Kumar - Head of Software Engineering

Abhijeet was previously an Engineering Lead at Nextdoor. Before that, he was a Staff Engineer at Workspot and a Software Engineer at Juniper Networks. He holds degrees from IIT Guwahati and the University at Buffalo.

Sarah Ahmad - Head of Customer Success

Sarah was previously Director of Enterprise Account Management, West Coast at WeWork. Before that, she was an Account Manager at Vendormate. She holds a degree in Marketing from the University of Georgia.

Sarah Quon — Head of Marketing

Sarah was previously a Product Marketing Lead at Opendoor. Before that, she was a Product Manager at Sephora. She holds a B.S. in Business Administration from USC.

James McKenna — Head of Finance

James previously held Finance and Strategy roles at Stripe. Before that, he was a Vice President at Serent Capital and an Associate at FFL. He holds an MBA from Stanford GSB and a B.A. in Economics from Princeton.

Danyal Kothari - Head of Operations

Danyal was previously a Product Manager at Uber. Before that, he was a Senior Associate Consultant at L.E.K. Consulting. He holds a B.A. in Chemistry from the University of Pennsylvania.

Pike Hughes - Head of Product Operations

Pike previously led charging infrastructure for North America at Tesla. He holds a B.A. in Economics & International Relations from Tufts.

David Richards - Head of Product Marketing

David previously held Product Marketing roles at Moveworks and Domo. Before that, he was a Strategy Consultant at Accenture. He holds an MBA from Northwestern and a B.A.Sc. in Bioengineering and Biomedical Engineering from USC.

Jeff Leopando — Head of Supply Chain Management

Jeff was previously a Senior Technical Program Manager at Facebook. Before that, he was a Project Manager at Apple. He holds a B.A. in Anthropology from Harvard and an MEng in Logistics, Materials, and Supply Chain Management from MIT.

Greg Cooper - Product Designer

Greg was previously the first product designer at Stripe, where he was for ten years. Before that, he was a YC founder.

Sean Rose - Product Manager

Sean was previously a Product Manager at Slack. Before that, he was a Product Manager at Box. He holds a B.S. in Symbolic Systems from Stanford.

Samrat Gupta - Software Engineer

Samrat was previously a Member of the Technical Staff at Cisco Meraki. Before that, he was a Software Engineer at Cisco. He holds an M.S. in Embedded Software Engineering from Carnegie Mellon.

Andrew Thorp - Software Engineer

Andrew was previously a Software Engineer at Stripe. Before that, he was a Software Engineer at Pure Charity. He holds a B.S. in Computer Science from Liberty University.

Eric Cheng - Software Engineer

Eric was previously a Senior Software Engineer at Uber. Before that, he was a Program Manager Intern at Microsoft. He holds a BASc in Systems Design Engineering from the University of Waterloo.

Andrew Kramolisch - Software Engineer

Andrew was previously a Senior Engineering Manager at EasyPost. Before that, he was a Senior Software Engineer at Airbnb. He holds a B.S. in Computer Science from Virginia Tech.

Isaac Diamond — Software Engineer

Isaac was previously a Software Engineer at Stripe. Before that, he was a Production Engineer Intern at Facebook. He holds a B.S. in Computer Science from UC San Diego.

Paul Ugolini — Software Engineer

Paul was previously a Firmware Engineering Intern at Samsara, a System Software Intern at Nvidia, and a Hardware Design Engineer Intern at Thimble.io. He holds a BS in Computer Engineering from Rochester Institute of Technology.

Shubham Saloni - Wireless Engineer

Shubham was previously a Wireless Software Developer at HPE Aruba. Before that, she was an R&D Embedded Software Engineer at Broadcom. She holds an MS in Computer Systems Networking from NC State.

Simon Symeonidis — Embedded Systems Engineer

Simon was previously a Software Engineer at AdGear. Before that, he was a Software Engineer at Aeras Inc. He holds an M.S. in Computer Science and a B.Eng. in Computer Software Engineering from Concordia University.

Hiram L. — Embedded Systems Engineer

Hiram was previously a Platform Firmware Architect at Avast. Before that, he was a Software Engineer at Remotium. He holds a B.S. in Computer Engineering from Cal Poly SLO.

Abhinav A. - Platform Engineer

Abhinav was previously a Staff Software Engineer at Samsara. Before that, he was a Senior Staff Engineer at Argosy Labs and a Member of the Technical Staff at Cisco Meraki. He holds an M.S. in Computer Science from Indiana University Bloomington.

Drew Sutton — Sales

Drew was previously an Account Development Executive at Salesforce. Before that, he was a Data Analytics Manager at IRA Group. He holds a B.S. in Business Administration from Georgia Tech.

Girish Gopalan — Strategic Partnerships

Girish was previously Head of Strategy and Operations for Stripe Issuing at Stripe. Before that, he was an Investor at King Street Capital Management. He holds a B.S. in Economics and a B.A. in Biology from Wharton/UPenn.

Conclusion

You’ll probably never stop getting mad at your computer.

If Meter’s successful, though, in the future it won’t be because of your internet.

If the 19th century brought us water as a utility and the 20th century brought us electricity, the 21st will probably bring us connectivity.

Meter’s hiring.

Thanks to Lachy and Frank for their help with this piece.

In case you missed our previous releases, check them out here:

And to make sure you don’t miss any future ones, be sure to subscribe here:

Finally, if you’re a founder, employee, or investor with a company you think we should cover please reach out to us at ericzhou27@gmail.com and uhanif@stanford.edu - we’d love to hear about it :)