Why You Should Join Clay

Bringing creativity back to GTM

Some opportunities to consider:

Clay has grown revenue from 5 to >30m in the past year, has taken less than 18 months to reach an eight figure run rate, and in the 9 months since we’ve started writing this has announced two new funding rounds. They’re currently hiring product and systems focused software engineers in New York City.

Modal has grown revenue significantly in the past year and has taken less than 18 months to reach an eight figure run rate. They’re currently hiring product and systems focused software engineers in New York City.*

Welcome to “Why You Should Join,” a monthly newsletter highlighting early-stage startups on track to becoming generational companies. On the first Monday of each month, we cut through the noise by recommending one startup based on thorough research and inside information from partnered venture firms. We go deeper than any other source to help ambitious new grads, FAANG veterans, and experienced operators find the right company to join. Sound interesting? Join the family and subscribe here:

Why You Should Join Clay

(Click the link to read online).

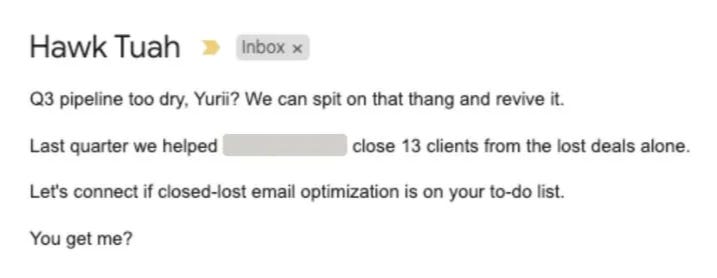

Cold email.

The last great art.

Some say literature peaked with Joyce. Storytelling with Woolf, and satire with Vonnegut. Harold Bloom, railing against the “school of resentment” that to him defined modern literature, once quipped we were witnessing the “final phase" of literary criticism. Lamenting the state of modern writing, critic Joseph Bottum mourned that “The novel didn't fail us. We failed the novel.” In A Reader’s Manifesto, B.R. Myers bemoaned “the growing pretentiousness of American literary prose” on behalf of readers everywhere.

Heartbreaking.

But Bloom, Bottum, and Myers must not have been spending time in their spam folders, where the great authors of our time have been doing their real work.

It takes vision to write the right cold email.

How many emojis should you use? Is using two exclamation marks in the same paragraph okay? How do you optimize the first 40 characters (the ones visible before truncation on mobile gmail), and how soon should you follow up? On subject lines - should you go lowercase for casual vibes, caps for urgency, or try starting with a “Re:” so they think it’s a response?

And on the endless amount of personalization you can do - how many LinkedIn posts or talks should you reference? Is mentioning the dog in their profile picture too much? Should you congratulate them on that work anniversary from 3 weeks ago?

If not an art, there’s at least a craft to developing the right outreach strategy - to finding the right people, writing the right message, and sending it at the right time. Getting creative with who, how, and when you hit prospects is the métier millions of of SDRs, recruiters, and call center employees junior VCs spend the first decade of their careers refining.

At its worst, this can be a rather soul-sucking task, the corporate equivalent of hazing. At its best, however, much of this work - outbound pipeline generation as the industry calls it - can be creative and rewarding. Many of us can probably remember the best cold call or email we’ve ever gotten, and the conversation it led to after.

Clay is promising to bring creativity and craft back to go-to-market, without the sacrifice of scale.

In the process of doing so, they’ve become one of the fastest growing companies in the world, and a promising one to consider joining.

Background: The Landscape of GTM Tools

Before getting too deep into Clay, it’d probably be helpful to understand the broader landscape of sales tooling they fit into.

Sales teams use many different types of tools. There are prospecting/pipeline-generating tools they use to help generate leads. There are CRMs that they use to help track and manage leads. There are sales enablement tools to help train sellers, and there’s an emerging category of sales agents to augment or even replace sellers entirely.

There are tools to help with every stage of the sales funnel.

In this section, we want to dive deeper into the world of prospecting tools specifically, as that’s the function most companies initially start using Clay for. To start, we found it helpful to break the process - usually done by Sales Development Representatives (SDRs) and involving everything up until the first meeting - into three stages.

Finding Leads

Prospecting usually begins by finding some list of people (prospects) or companies (accounts) to reach out to. These lists can come from lots of different sources - they might be subscribers to the company newsletter, members of a Slack community, developers who have starred a Github repository, or, most commonly, a filtered set of targets drawn from LinkedIn or some other data provider. Alongside LinkedIn, some popular vendors of prospects and their contact information include:

Apollo - a database of 275M+ contacts and 73M+ companies.

RocketReach - a database of 700M+ contacts and 60M+ companies.

ZoomInfo - a database of 321M+ contacts and 104M+ companies.

Lusha - a database of a 150M+ contacts and 50M+ companies.

As a sales rep with a territory and customer profile to target, you would usually begin by pulling a list of all the prospects and accounts that fit your criteria. For instance, if you were selling AI-enabled customer support software to midsized B2B tech companies in the Bay Area, you might begin by using Apollo to pull a list of companies who are in San Francisco, have between 50 and 500 employees, and are in the Computer Software industry. Then, you would pull the name and email of each company’s corresponding customer support leader.

Researching Leads

Once you have a basic list of prospects, you often use additional information around each company and person to filter it down further. Some more advanced data points to incorporate here might include where the person sits in the company’s org chart, what other tools the company uses today, how the company is doing in terms of revenue or web traffic, or how many job listings the company has posted.

Gathering these data points - a process called enrichment - can be done by aggregating information from specialized vendors. For instance:

Crunchbase is a source on a target account’s size. It has information on a company’s investors, funding amount, and funding stage.

Crystal is a source on source on buyer personalities. They’ve scraped public data to create personality profiles for anyone with a social media presence.

BuiltWith is a source on company tech stacks. They tell you what tools and technologies a company is using, like if they’re on Zendesk, Shopify, BigComerce, or Klaviyo.

Semrush is a source on company web traffic. They provide estimates of monthly traffic for specified domains, as well as guesses around who a company’s competitors are.

To continue our above example, an SDR selling customer support software to midsized B2B tech companies might further filter their list down by targeting accounts who are both using legacy support software and experiencing inflecting growth. To do so, they might filter their list down to companies who are current customers of Zendesk or Freshdesk and who have also recently raised a round of funding or seen significant headcount growth.

This is also where you would spend time manually researching prospects, which might include looking at the account’s website, listening to a recent interview with the CEO, or skimming through the company’s blog. For instance, if your prospect has a LinkedIn post advertising a new support opening on their team, you could eventually reference that in your outreach and explain how your product helps reduce the number of people they need to hire.

Outbounding Leads

Finally, once you have a filtered list of contacts and the information needed to personalize things, the final step is to actually reach out. This means writing and sending emails, making cold calls, and following up until you receive a response.

Copywriting and sequencing are the main aspects of this stage, which mean writing the email and defining the outreach/follow up strategy. Tools for these tasks include:

Copy.ai - a tool for AI-powered copywriting. They help generate marketing copy, ad headlines, and social media content.

Jasper - a tool for AI-driven content creation. They specialize in long-form content, brand voice consistency, and marketing automation.

Mailgun - a tool to help deliver emails. They provide APIs for sending, receiving, and tracking emails with high reliability.

Lavender - a source for AI-assisted email personalization. They optimize cold emails with real-time coaching, personalization, and data insights.

To continue our above example of selling support software to midsized tech companies who are both growing quickly and on a legacy platform, you might try referencing their rapid growth and asking if their current system - Zendesk or Freshdesk - is doing enough for them. If their head of customer service is trying to hire several people, you might explain how your product can help reduce headcount needs.

Optimizing, coordinating, and automating these three basic functions - finding people to contact, researching them, and reaching out - is what most of modern sales tooling is built around.

As the space has matured, many of the companies we mentioned (i.e. Apollo, ZoomInfo) have expanded into supporting more than one of these functions, which is why the market today can feel somewhat soupy. Many of the newer “AI x Sales” or “AI-native GTM” companies who support top-of-funnel operations have bundled or abstracted away a number of these functions as well, which hasn’t helped. Some emerging categories of products in this space you might’ve heard of include:

AI SDRs. Companies like 11x, Artisan, and AiSDR are building AI sales representatives with the goal of automating full, end-to-end pipeline generation - their agents they will pull the list, research the prospects, and reach out for you.

Inbound pipeline generation. Unify, Koala, Warmly, Common Room leverage first-party data (i.e. who’s visiting which page of your website when) to help exploit warm leads. They still help drive top-of-funnel, but focus more on inbound than outbound and are so are their own category.

Intelligent CRMs. Rox, Day, Folk, and other AI CRMs help users monitor and research prospects in the background, while tools like Actively bring intelligence to existing CRMs by helping users prioritize existing accounts.

While it can be challenging to make sense of how everything fits together, broadly speaking, each of these companies has approached by the market by either trying to own either a key data source (i.e. third-party data like Apollo/Crunchbase or first-party data like Unify/6Sense) or a key workflow (i.e. writing emails like Copy.ai, researching leads like Rox, or the entire pipeline-generation process like 11x). That is, they define themselves by having either some advantage on data or some advantage in automation.

To us, what makes Clay unique is how while they’re world-class at helping with each of the functions above, they’ve approached things by fundamentally owning no data source or workflow.

Clay’s Approach

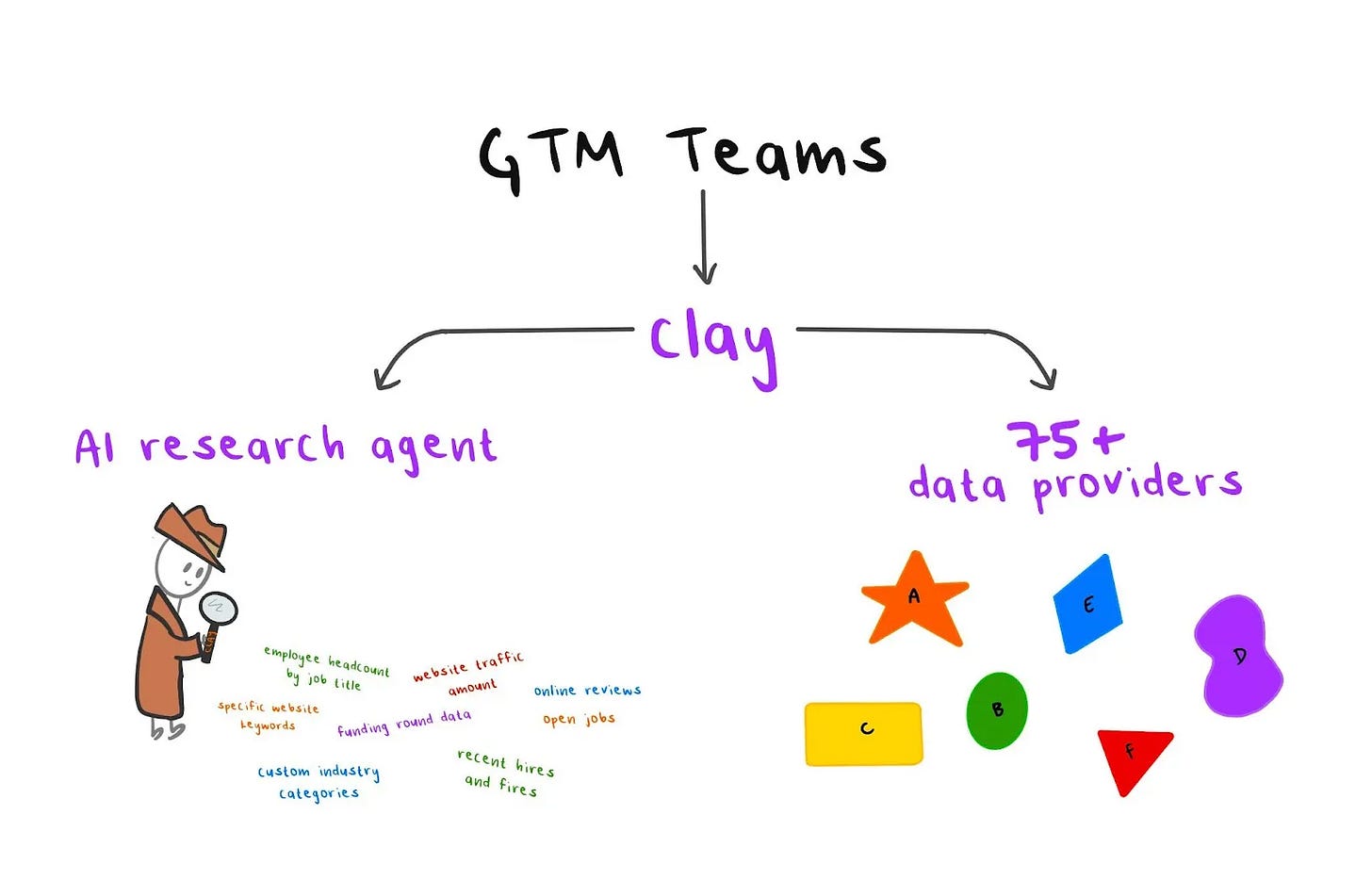

Like the companies mentioned above, Clay supports businesses with workflows related to outbound pipeline generation - companies usually start using them to surface, research, and contact relevant leads for their business.

Unlike the above products, however, which each aim to own some data source or workflow, Clay is more of an integration and orchestration layer on top of a bunch of other data sources (i.e. Apollo, Crunchbase, 6Sense, Salesforce) and automation primitives (i.e. ChatGPT, Zapier, Salesforce, Sendoso). People use Clay as a no-code tool to stitch these data sources and tools together into longer workflows, allowing Clay to support a broader and more personalized collection of automations than other tools. As we will explore, it’s this approach that’s made them so uniquely powerful in an increasingly crowded market.

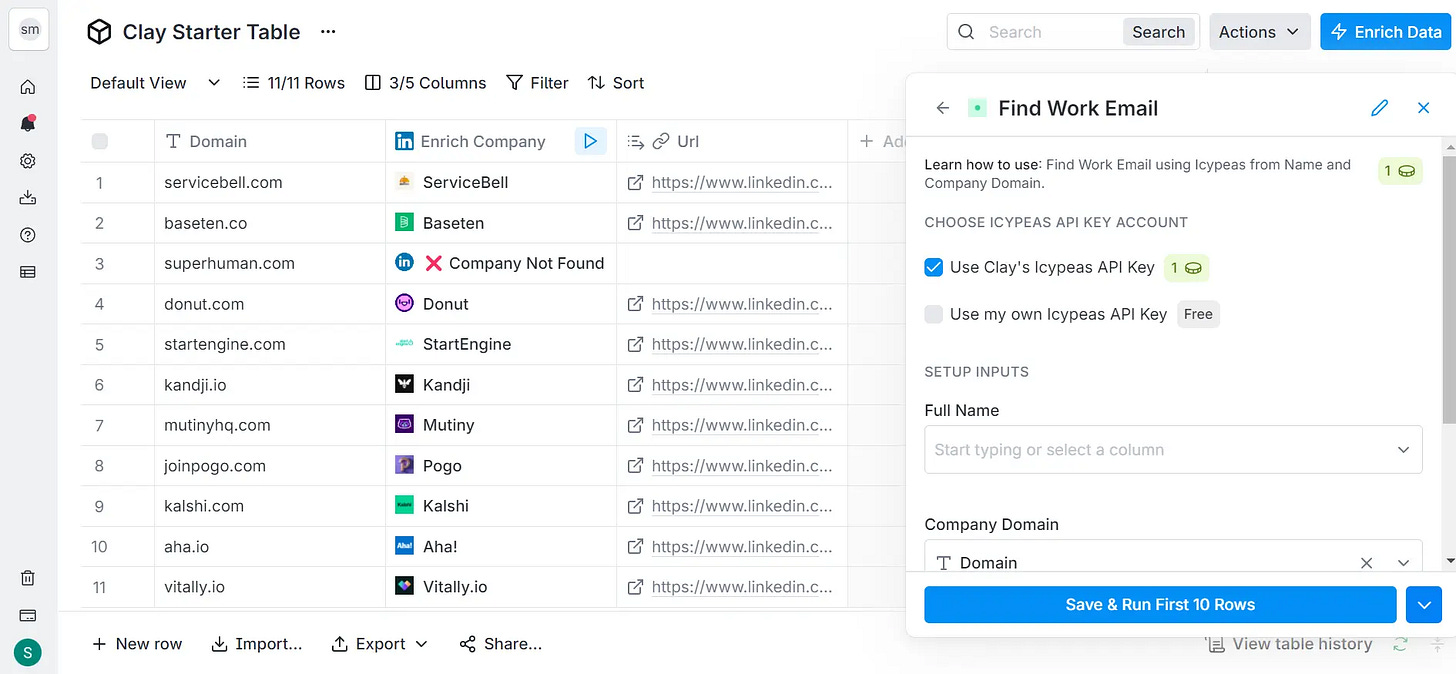

Concretely, Clay's product takes the form of a table. In each Clay table, each row represents an account or prospect, and each column represents either a data point on that prospect (i.e. their name, website, or LinkedIn profile) or some transformation on a prior column. For example, if the first column is the account’s name, the second column might use Apollo to pull the company’s website based on the name, and the third column might use Crunchbase to pull the company’s funding based on the website.

Going back to our example of a company selling customer support software, a basic Clay workflow might involve automating the core find, research, and outbound loop:

Using Clay’s company and people database, you could assemble a list of leads by pulling every software company located in the Bay Area with over 50 people and a head of customer support.

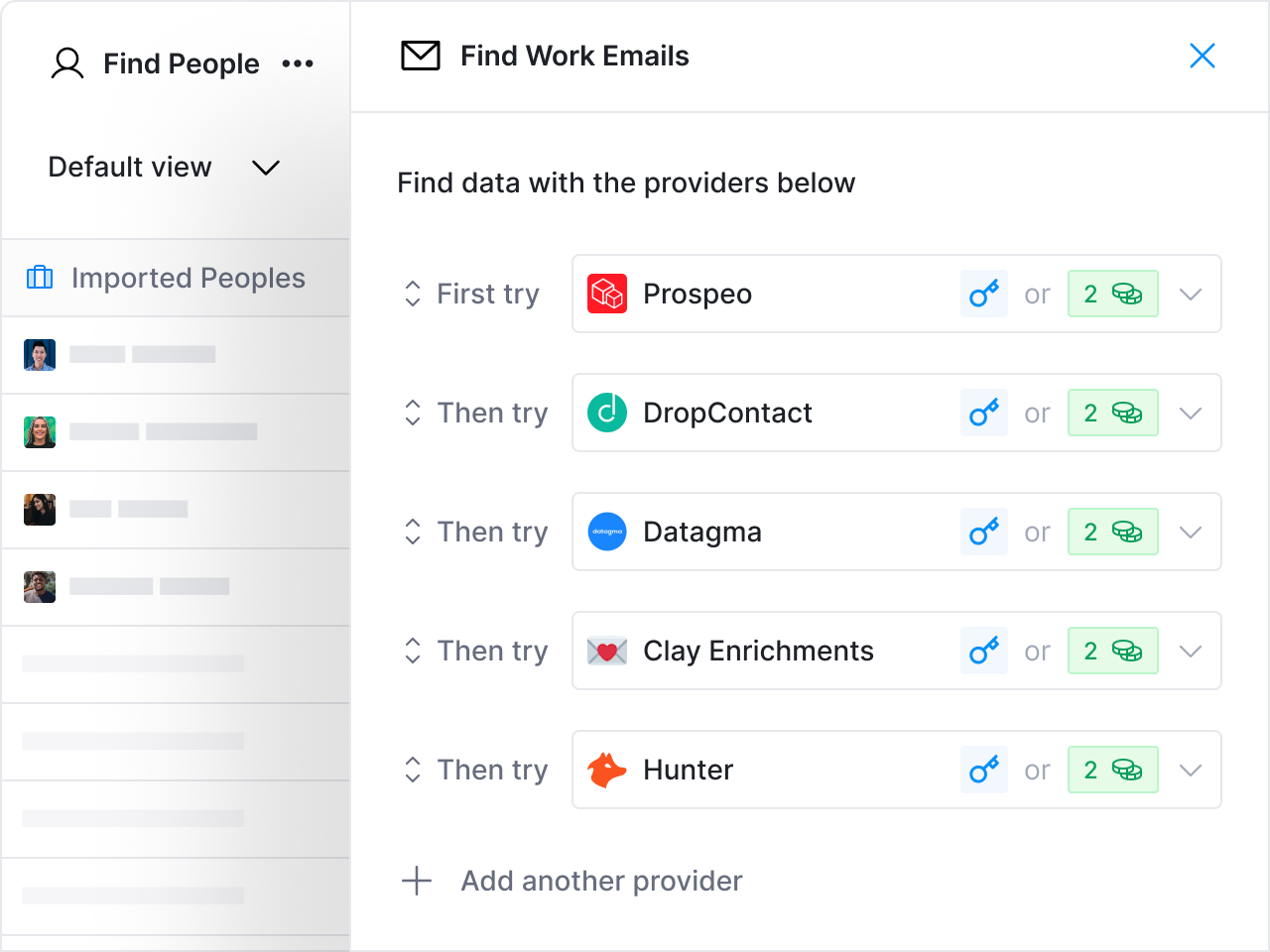

Next, by creating a few columns and using the relevant integration for each, you can enrich each lead with data points around growth rate, capital raised, the size of their support team, the tools they’re currently using, and relevant contact information. As an orchestration layer, Clay centralizes all of these disparate data sources and even has a waterfall system where if one source doesn’t have the information you need, a number of backup sources are automatically queried.

Next, you can research each lead using the Claygent tool - a web research agent that can answer custom questions about each prospect. For instance: Who are their customers? What's their product’s value proposition? What's a typical support question they might encounter? You can create a Claygent column for each of these questions and generate answers.

Finally, you can draft an email using the OpenAI tool, which incorporates the data you’ve pulled in prior columns along with any templates you might want to use. You can then use one of the sequencing tools Clay is integrated with to send the email.

The waterfall enrichment scheme and web research agent were two early innovations that made Clay great for this basic use case, which ended up becoming a wedge for the product. They also demonstrate the fine balance Clay has struck - being verticalized enough to excel at bread-and-butter GTM workflows, yet flexible enough to enable completely new ones. This second point is where Clay’s strength and staying power has come from: what users find charming about the product is how creative you can get with it.

Getting creative. Clay's real power comes from chaining its columns and transformations in new ways, which is how users can create new GTM and GTM-adjacent workflows. With the right combination of columns, you can automate capturing a screenshot of a prospect’s webpage, scoring a prospect’s Typeform submission and automatically personalizing a follow-up, generating transcripts from a prospect’s YouTube videos, and generating content from a customer’s support conversations.

Staying cohesive. Despite this diversity, what keeps things cohesive is the simple table format underlying everything. Beyond naturally enabling massive parallelism, this commonality makes it easy for people to share and understand different workflows, as they all take the same form. Each workflow and campaign feels consistent in its touch, and this keeps Clay usable as a product.

The long tail of workflows and automations you can build only with Clay is what makes the product so sticky and powerful.

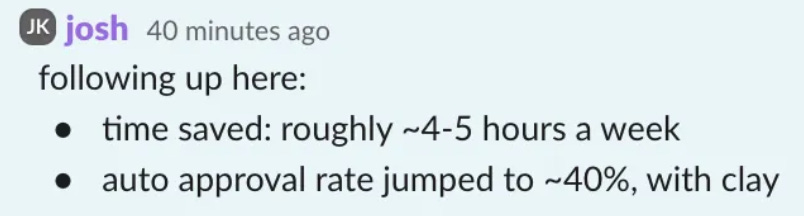

Clay launched publicly in early 2022 and has has grown swiftly ever since. The company went from 0 to multiple 8 figures of revenue in just over two years, and today serves many of the most notable companies in tech: customers today include Ramp, Anthropic, Square, Dropbox, Notion, Verkada, Brex, and DBT. Users like the product:

The company was founded in 2017 by Kareem Amin and Nicolae Rusan. Kareem was previously VP of Product at the Wall Street Journal, a cofounder of Frame (acquired by Sailthru), and a Program Manager at Microsoft. Nicolae was previously VP of Product at Dow Jones, Kareem’s cofounder at Frame, and a Program Manager at Microsoft. In 2021, they were joined by Varun Anand, a third cofounder who was previously Director of Operations at Newfront, Head of Expansion at Candid, and the Special Projects & Communications team at Google. Clay originally spent 4 years building a more general-purpose no-code tool and initially launched with that. After getting no traction and spending some time wandering through the desert, they pivoted to focusing on outbound sales and revops workflows specifically. PMF quickly followed, and they were then off to the races.

Throughout all this, Clay has raised a $2.5M seed round led by First Round capital, a $13.5M Series A led by Sequoia Capital, and a $46M Series B led by Meritech Capital. They recently became a unicorn and raised a further $40M Series B expansion, also led by Meritech.

Clay has had an incredible trajectory over the past two years, but we’d like to go a bit deeper when examining whether they might be worth joining as a company.

There are two points in particular that matter when answering this question:

Is Clay operating in a great market?

Is Clay well-positioned within that market?

The Market for Go-to-Market Tools

Clay makes money when companies use them for different GTM-related workflows and automations.

You probably don’t need convincing that GTM teams buy a lot of software - as a revenue generating function, their tooling needs are usually a top priority. Additionally, since sales and marketing teams typically have substantial budgets (around 38% of revenue for software companies), any efficiency boost or cost-saving they can find is taken seriously. There’s a reason companies spend $107.5 billion globally on CRMs, and why US businesses spend over $800 billion a year on sales force compensation.

Even looking solely at the market for prospecting tools, the market opportunity is impressive:

A lot of companies prospect. The US alone has roughly 5.7 million sales professionals, of which nearly half (47.2%) primarily work remotely as inside sales reps—meaning they're looking for prospects online.

Prospecting takes a lot of time. Over 40% of salespeople cite prospecting as their biggest challenge, ahead of even closing (36%) and qualifying (22%) leads. Just drafting emails consumes an average of 21% of their workday.

If Clay can meaningfully improve the efficiency or effectiveness of these prospecting efforts—by improving personalization (personalized emails see 2.5x higher response rates), saving time, or enabling greater scale — companies will gladly pay for that.

But what's exciting about Clay is that it's more than just another prospecting tool—it's a no-code workflow builder deeply integrated with AI. This positions Clay right at the intersection of some compelling trends:

The adoption of no-code and low-code tools. The market for no and low-code tools is expected to reach $50 billion by 2028, with some 75% of businesses projected to adopt some combination of them. Already, nearly 60% of new applications are being built outside of IT, often by employees with limited or no technical skills. Companies embracing these tools report significant improvements in speed, with 29% of organizations seeing their app delivery timelines cut in half. The rise of companies like Bolt and Lovable, which each reached $10 million in revenue in under two months, show the sizable demand for these sorts of tools.

The growing importance of personalization in sales. 79% of B2B marketers agree that personalized content is the best way to engage buyers, with companies using these strategies seeing revenue growth jump by 10-15%. With AI now powering personalized outreach, this is becoming standard practice — 92% of businesses already use AI-driven personalization, making advanced personalization tablestakes to stay competitive.

The rise of Generative AI. Gartner projects that by 2028, 60% of B2B sales tasks will be executed generative AI—up from less than 5% today. Already, 65% of businesses use generative AI in at least one function, primarily marketing and sales. Teams leveraging AI in sales overwhelmingly report better outcomes: 83% experienced revenue growth and 68% saw headcount growth, compared to only 66% and 47%, respectively, among teams not using AI.

Perhaps most importantly, though, startups selling into revenue-focused teams have an especially favorable market dynamic:

The ROI is straightforward to quantify: Are you generating more leads at a lower cost? Clear ROI helps internal champions justify spending and close deals faster. This contrasts with selling something like HR analytics software, where the ROI can be less obvious or take longer to measure.

Budgets for revenue-generating teams are usually protected during downturns, because these teams directly impact the company's bottom line. In comparison, something like employee engagement or culture software might be first to go, because their impact is harder to directly tie to short-term financial outcomes.

Revenue teams tend to be open to experimenting (you always need more leads), allowing startups to scale quickly without hitting common roadblocks like the slow-moving procurement cycles in government or highly regulated industries.

All of this adds up to shorter sales cycles, larger potential contracts, and opportunities for rapid revenue growth. In other words, Clay’s market is structurally more attractive than most.

Clay’s Positioning

So, of all the intelligent pipeline-generation tools out there, why do we (and so many others) like Clay’s the best? How have they become a "default" tool that seems to show up in nearly every startup’s toolkit — alongside the likes of Notion, Slack, or Ramp?

We'll analyze this question from a few angles. First, we'll start at the product level to understand what specifically makes Clay unique. Next, we'll move up a level to explore the principles guiding their approach to building the product. Finally, we'll zoom out further to examine how Clay has approached its own go-to-market strategy and market positioning.

Product

At the most basic level, Clay stands out because of a handful of novel features. Consider the typical prospecting workflow we discussed earlier — Clay was the first to market with meaningful improvements at each step:

Enrichment: via "Waterfall Mode"

Research: via "Claygent"

Copywriting: via AI-driven prompts

Individually, each of these features represented a specific upgrade over previous methods. Waterfall mode, for instance, saved users money because they no longer had to subscribe individually to multiple data services — Clay gave them just what they needed, à la carte. Together, these targeted improvements gave Clay its initial wedge into prospecting, which drove much of its early adoption and growth.

If you speak with users, though, Clay’s true uniqueness and magic emerge when you start chaining these and other individual capabilities together. Additional steps you might leverage to create workflows include cleaning or modifying data, running it through custom JavaScript, cross-checking and syncing with your CRM, scraping websites, performing automated Google searches, hitting arbitrary APIs, or executing custom AI prompts. Some sophisticated workflows we’ve seen people build with Clay:

You can set up a webhook to automatically import meeting data—dates, attendees, emails—directly into a Clay table, then use Clay’s HTTP API column to trigger a Zapier integration that formats notes and syncs them directly into Notion.

You can paste a LinkedIn profile link into a Clay table, instantly creating a profile with the user’s recent posts, personality insights, business type, and decision-making authority. Clay can then send you a Slack message with a neatly formatted Google Doc containing detailed company research—recent news, acquisitions, product launches, customer case studies—all automatically organized for you.

You can create a table of LinkedIn influencers and have Clay automatically enrich it with follower counts, recent post topics, and average engagement metrics (likes, comments). You can set this up so that whenever you add a new influencer, their recent posts automatically populate another Clay table, ready to export to Google Sheets for deeper analysis.

This ability to chain basic actions together unlocks entirely new automations that simply weren’t possible before — exactly what a robust no-code or low-code platform should provide. This makes sense once you understand Clay’s origins: the product was originally billed as a general-purpose, no-code spreadsheet tool — “a spreadsheet that can fill itself.”

Over time, Clay layered deeper specialization around go-to-market workflows, moving away from recruiting, accounting, and other general use cases. Today, it's evolved into a purpose-built, no-code platform tailored specifically for that vertical. Its tabular format gives users the granular control, visibility, and massive parallelism required for outbound-related workflows at scale.

While many SaaS tools handle the basics of prospecting, very few serve the "long tail" of niche tasks that salespeople frequently want to automate — things like taking automated screenshots of prospect websites, scraping founders’ LinkedIn posts, or moving data into and out of Salesforce/Hubspot. Clay addresses these previously unmet needs in a polished and flexible way.

Fundamentally, its popularity comes down to the fact that Clay enables users to build workflows that they just simply couldn’t before.

Branding and Distribution

The novelty to Clay’s product explains part of their early adoption, but there's more to their momentum. So, what’s set them on a path to becoming one of those "default" tools every startup has heard of and tried — like Notion, Rippling, Ramp, or Slack?

It’s actually kind of an intriguing question, and we spent a good amount of time thinking about it. Besides building a strong and differentiated product, we’ve noticed a few attributes common among startups that seem to achieve that rare “it” factor:

Craftsmanship: Builders, not bureaucrats, typically run startups. These people deeply appreciate well-crafted, thoughtfully designed products. Companies like Figma, Linear, and Stripe have all benefited from this mindset.

Creativity, Customizability, and Personalization: Startups are full of people who love experimentation. Growth hackers, product engineers, and “founding” employees of any sort like modular but “compound” tools they can adapt and personalize to their needs — think Airtable, Notion, or Rippling.

Ecosystem and Community: Startup employees are constantly talking, sharing, and recommending tools to each other. If there are specific influencers dedicated to sharing tips about your product, you are probably in a good spot. Companies that do a great job cultivating and leveraging communities tend to gain momentum quickly — i.e. Notion, Vercel, and Cursor.

Clay shows up well along each of these axes. It’s a thoughtfully designed, highly customizable product with a thriving community of power users who frequently share tips, hacks, and creative workflows with one another. Clay intentionally fostered this sense of community early on through an unconventional approach: they channeled all customer support exclusively through a single Slack community, eliminating traditional email and chat support. The community started with just 200 people, and has now grown to over 11,000. In addition, the company has actively nurtured a small ecosystem of "claygencies," specialized consulting firms who help new users adopt and implement Clay, by showcasing these partners on their social media channels and website. Collectively, these moves have positioned Clay well among brand-name customers known for being tastemakers in enterprise software.

This is important, because there’s also often some degree of path-dependence at play when becoming a “hot” company. Not all revenue is created equal - given the choice, it’s far better to have your revenue coming from brand-name companies than unknown ones or a random collection of SMBs. This is because future customers will often look to the vendor well-known companies use to inform their own decisions around what’s the industry standard. A big part of the enterprise sales cycle is your champion selling your tool internally, and it’s a lot easier for them to do this when they can point to a leading company in their vertical (with a more sophisticated procurement process) using it also. If you’re selling to other startups, like Clay has been doing, having customers like Ramp, Verkada, Notion, Brex, and Anthropic are usually the early signal future customers will look for.

Clay’s early customer list put them on this trajectory, and this has given them a leg up.

The Long Term

In the limit, what does something like Clay become?

Varun described their goal as becoming "the final growth tool" — something used if you're involved in sales, marketing, or anything growth-related.

There’s a reasonable roadmap to achieving this: Clay can always expand its scope by integrating more tools and data sources. Our main question revolves around the table UI they’ve committed to — at what point does it eventually become limiting? The current interface excels at parallel tasks but might struggle with workflows that run in the background or that rely on more complex triggers. Perhaps, longer-term, Clay could begin moving back toward its roots, evolving into a broader, pure-play automation platform.

One perspective we have more conviction on is around the future of AI-driven sales. As research agents, cold email generators, and similar tools become commoditized, the novelty and effectiveness of traditional, personalized outbound will diminish, turning once-meaningful signals into noise. When hyper-personalized outreach becomes the norm, how will the best go-to-market teams differentiate themselves? To us, the frontier will always involve some form of creativity and hustle — real human effort that can be scaled but difficult to automate out-of-the-box. Because of this, tools like Clay, which support flexible experimentation and keep a human in the loop, will remain important. They'll enable teams to continuously evolve their go-to-market workflows, the fluctuations of which will remain an important source of competitive advantage.

Competitive Landscape

Now that we have an understanding of Clay, we can take a deeper look at how they stack up against their competitors.

While there isn't a company offering exactly what Clay does — a no-code tool specifically verticalized for sales — there are several adjacent categories of companies vying for similar territory and competing for the most promising talent and mindshare in the space.

The two that you’ve probably heard of, and we’d like to discuss in more detail, are AI SDRs and AI CRMs.

Clay versus AI SDRs

We’ll start by focusing on AI SDRs, which include the likes of 11x, AI SDR, and Artisan, among others. These platforms aim to automate the entire top-of-funnel process, from prospecting and lead generation to outreach and engagement, with the aim of replacing human SDRs entirely. 11x’s Alice, for instance, will automatically find a list of leads, filter them down to the highest-intent prospects, draft personalized emails to each, email them, and follow up until a meeting is booked. It does so autonomously and at scale, allowing for high-volume outreach.

In contrast, Clay isn't looking to replace human sales teams. Instead, it’s fundamentally designed to empower and augment human-driven workflows. Looking into the future, there are several reasons this may position Clay more advantageously:

Avoiding the "personalization arms race": As AI-driven SDRs lead to a flood of automated cold emails, competition intensifies around who can deliver the most convincingly personalized message at scale. What we consider effective personalization today may quickly degrade into spam tomorrow, as email as a channel degrades and prospects become overwhelmed by indistinguishable AI-generated outreach. Clay avoids this trap by keeping humans at the center, leveraging their creativity to craft genuinely differentiated outreach strategies.

Humans aren’t going anywhere: Sales fundamentally involves relationships and navigating nuanced human dynamics, especially in enterprise scenarios. While many tasks can be automated, people will always buy from people. Human go-to-market professionals won’t disappear, and at moments will continue to remain responsible for both strategic oversight and intricate, tactical interactions.

Ultimately, the key question is this: What should be the human role in sales and SDR workflows moving forward? If you believe in fully automating sales from start to finish, then joining an AI SDR company might be more exciting for you. But if you think humans will remain essential to the process — and that the future lies in enhancing human potential rather than replacing it — then you may be happier at Clay.

Clay versus AI CRMs

Next, let’s have a look at the AI CRMs, which include the likes of Rox, Day, and Folk, among others. These products offer a CRM with a number of AI-driven bells and whistles built in or on top: Rox, for instance, will research prospects in the background, identify the optimal time to ping them, draft an email, and offer to do so for you. Another common feature is automated record cleaning and data ingestion.

While AI CRMs share some similarities with Clay, particularly in their goal to empower human sellers, we don't view them as direct competitors. For one, AI CRMs generally target mid-funnel activities like nurturing and converting leads already within the sales pipeline. Clay, by contrast, generally focuses on top-of-funnel tasks like supporting initial outreach and prospecting efforts. In addition, Clay doesn't aim to replace the underlying CRM — instead, it serves as a flexible application layer complementing existing CRM systems.

We quite like the innovations AI CRMs bring to the table (and will explore one in more depth sometime in the future), but if you can only join one company here are a few reasons to prefer Clay:

Supporting diverse, customizable workflows: Clay’s no-code nature allows it to support the long tail of workflows. It supports specialized, user-developed tools for enrichment, personalization, and workflow customization — capabilities that AI CRMs won’t have built into them.

Complementary, not competitive: Clay doesn't compete directly with foundational CRM tools like Salesforce; instead, it enhances their utility. While Salesforce might be a garbage product, it remains incredibly entrenched and durable as the core system of record in sales organizations.

Ultimately, the key question is this: Will Salesforce and Hubspot still be as dominant in a decade? If you believe AI has the potential to meaningfully disrupt the core CRM landscape significantly within the next ten years, then joining an AI CRM-focused company might be compelling. But if you think the current systems of record are likely to persist, then Clay may be more interesting as a layer built on top of them.

Team

Clay wants to be the starting point for anything outbound-related.

It’s an ambitious vision, but they’ve put together an excellent team to make it happen. Consider a random sampling of their roster:

Kareem Amin — Co-Founder, CEO

Kareem was previously the VP of Product at The Wall Street Journal. Before that, he was the Co-Founder of Frame, which was acquired by Sailthru. He holds a BEng in Electrical Engineering from McGill University.

Varun Anand — Co-Founder, Head of Operations

Varun was previously founded the venture fund 89 Christopher, which he now does as a side gig in addition to Clay. Before that, he was the Director of Operations at Newfront, Head of Expansion at Candid, and worked on special projects at Google. He holds a BA in Political Science from the University of Pennsylvania.

Osman Sheikhnureldin— Head of GTM Operations

Osman was previously a Senior Marketing Operations Manager at Rippling. Before that, he was the Head of Growth at Shelf. He holds a BA in Political Science & History from George Washington University.

Nefaur Khandker — Head of Product Design

Nefaur was previously a Founding Designer at DoubleLoop. Before that, he was a Principal Product Designer at Arcadia and at Khan Academy. Earlier in his career, he was a Software Engineer at Apple. He holds a BS in Computer Engineering from Virginia Tech.

Puneet Sabharwal — Head of People and Brand

Puneet was previously the Co-Founder and CEO of Horti. Before that, he was the Head of Product Design at Olo (valued at over $1 billion). He holds a BFA in Commercial Art from the College of Art, Delhi.

Alex Miller — Machine Learning Engineer

Alex was previously a Machine Learning Engineer at Yahoo, Cove, Reddit, and Twitter. He holds a BA in Mathematics from Wesleyan University.

Luna Ruan — Engineering Manager

Luna was previously a Tech Lead at Meta. Before that, she was a Software Engineer at Pinterest. She holds a BS in Computer Science from Carnegie Mellon University.

Cara Silverstein — Engineering Manager

Cara was previously an Engineering Manager at Materialize. Before that, she was a Senior Software Engineer at Attentive and at Google. She holds a BSE in Computer Science from Princeton and an MBA from Harvard.

David Stevens — Engineering Manager

David was previously an Engineering Manager at SevenRooms. Before that, he was an Engineering Manager at Peloton and a Data Scientist at Uber. He holds a BA in Mathematics from Williams College.

Nancy Dong — Partnerships Lead

Nancy was previously the Founder and CEO of Punchcard. Before that, she was an investor at FJ Labs. She holds a BA in Economics and Political Science from Northwestern and an MBA from Harvard.

Scott Tousley — Head of Content

Scott was previously the Head of Marketing at Persefoni. Before that, he was the Head of Startup Growth at HubSpot and a Senior Content Marketing Manager at Siege Media.

Alex Kloeti — Enterprise Growth Strategy

Lex was previously a Senior Revenue Operations Strategist at RevPartners. Before that, he was an Account Executive at Gong. He holds a BS in Economics and Computer Science from McGill University.

Collin Fijalkovich — Senior Software Engineer

Collin was previously a Software Engineer at Snap. Before that, he was a Software Engineer at Google. He holds a BE in Electrical Engineering and Computer Science from MIT.

Mark Hahnenberg — Software Engineer

Mark was previously a Software Engineer at Meta. Before that, he was a Software Engineer at Airtable, a Staff Software Engineer at Nylas, and a Software Engineer at Facebook. He holds a BS in Computer Science from Carnegie Mellon University.

Larry Li — Software Engineer

Larry was previously a Senior Software Engineer at Google, where he spent seven years. He holds a BS in Computer Science and Mathematics from Rensselaer Polytechnic Institute.

Anna Wang — Product Engineer

Anna was previously a Product Engineer at Retool. She holds a BS in Computer Science from Harvard University.

Josh Hanson — Data Scientist

Josh was previously a Data Scientist at Eppo. Before that, he was a Senior Product Data Scientist at ChowNow and a Product Data Scientist at Loom. He holds a BA in Economics from the University of Kansas.

Brian Liang — Software Engineer

Brian was previously a Software Engineer at RockSet (acquired by OpenAI). He holds a BA in Computer Science from Northwestern University.

Conclusion

There’s an art to writing a great cold email -

- just as there is for the rest of your GTM activities.

Finding that perfect balance of creativity and efficiency in your work — whether that's sending pizzas to your customers’ offices, Venmo-ing them your contact details, or including personalized screenshots of their website in an email — is the most important thing in standing out and getting ahead.

That spark of creativity is exactly what's missing from most next-gen sales tools, but has been baked into Clay from the start.

To recap:

Clay is unique. Every other piece of sales/growth software (Apollo, Artisan, Rox, 6Sense, etc.) tries to own some data source or workflow. Uniquely, Clay tries to own neither; it is an integration and orchestration layer on top of other data sources and automation primitives. This has made Clay better at executing on core workflows, better at attacking the long tail of workflows, and made the product both stickier and easier to adopt.

Clay is creative. Clay is centered around creativity, something baked deep into the history, culture, and DNA of the company. Beyond being a value we believe deeply in, this creativity is central to the future of effective GTM; in a world where millions of AI SDRs are sending emails and making cold calls, effective GTM teams will leverage Clay’s balance of creativity and scalability to separate themselves from the noise.

Clay is powerful. You can run a simple outbound email generation pipeline, but you can also use it to import meeting data from Zoom, generate a set of notes, and add the notes to a Notion table. The composability built into the platform makes it uniquely capable of automating GTM workflows no startup will build bespoke software for.

They’re hiring.

In case you missed our previous releases, check them out here:

And to make sure you don’t miss any future ones, be sure to subscribe here:

Finally, if you’re a founder, employee, or investor with a company you think we should cover please reach out to uhanif@stanford.edu - we’d love to hear about it :)